(文/翻译:阿浦美股)全文通读需要10分钟左右,强烈建议收藏!

一年一度的“巴菲特致伯克希尔股东们的信”来啦~ 跟随阿浦一起来学习吧!

精华速览

1. 关于伯克希尔回购股票:

去年,我们花247亿美元回购了相当于80998股伯克希尔哈撒韦A股的股票,因为我们相信,这些回购既能提高股东的每股内在价值,也能让伯克希尔拥有充足的资金来应对可能遇到的任何机会或问题。

伯克希尔自去年底以来回购了更多股票,并且将来可能会进一步减少其股票数量。苹果也公开表示有意回购其股票。随着流通股的减少,伯克希尔的股东不仅将在我们的保险集团、BNSF(美国伯灵顿北方圣太菲铁路运输公司)和BHE(伯克希尔·哈撒韦能源公司)中拥有更大的利益,而且还会发现他们对苹果的间接所有权也在增加。

2. 关于投资的反思:

我相信我的结论是正确的,即随着时间的推移,PCC将在其业务中投入的净有形资产中获得不错的回报。然而,我在判断它未来的平均收益上出现了错误预估,因此,我对PCC付出的收购价格的计算也是错误的。PCC绝不是我所犯的第一个类似错误。但这确实是个很惨痛的错误。

3. 再提“裸泳论”:

狂欢终会结束,当潮水褪去,我们会发现许多商业“帝王”不过是在裸泳。回顾金融史,有太多曾被记者、分析师和投资银行家誉为商业天才的著名企业家,但他们创造出来的东西最终却成了商业垃圾。

4. 对待投资的态度:

我花了很长时间才意识到这一点,但查理的说服,和我在伯克希尔挣扎于纺织业务20年的经历,最终让我相信,成为一家优质公司的非控股股东远比100%控股一家边缘公司更有利可图、更享受、而且工作量少得多。

5. “每年必提”——浮存金:

浮存金与银行存款有一些相似之处:保险公司的现金流每天进出,而保险公司所持有的现金总量变化不大。伯克希尔持有的巨额资金可能会在很多年内保持在目前的水平,而且从累积的角度看,这对我们而言一直都没有成本。

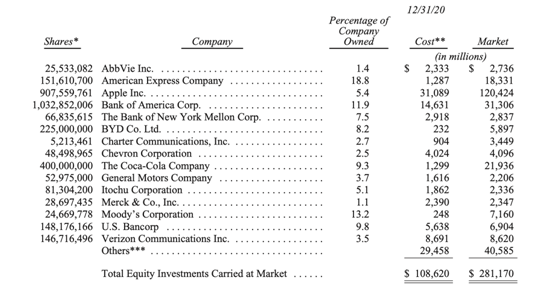

6. 持仓Top10:

财报显示,伯克希尔持仓市值前十的股票分别为苹果(市值1204亿美元)、美国银行(市值313亿美元)、可口可乐(市值219亿美元)、美国运通(市值183亿美元)、Verizon通信(市值86亿美元)、穆迪(市值71.6亿美元)、美国合众银行(市值69亿美元)、比亚迪(市值58.97亿美元)、雪佛龙(市值40.96亿美元)、Charter通信(市值34.5亿美元)。

7. 坚定“美国梦”:

如今,许多人在世界各地创造了类似的奇迹,创造了使全人类受益的繁荣。然而,在短暂的232年历史中,还没有一个像美国这样释放人类潜能的孵化器。尽管出现了严重的中断,但我们国家的经济发展一直是惊人的。

我们坚定不移的结论:永远不要和美国对赌。

8. 关于今年的股东大会:

将于5月1日在洛杉矶举行,而不是以往的奥马哈。雅虎将全程线上直播。

查理芒格回归!并表示期待2022年可以恢复线下股东大会。

正文全文翻译

To the Shareholders of Berkshire Hathaway Inc.:

致伯克希尔·哈撒韦公司的股东

Berkshire earned $42.5 billion in 2020 according to generally acceptedaccounting principles (commonly called “GAAP”). The four components of thatfigure are $21.9 billion of operating earnings, $4.9 billion of realizedcapital gains, a $26.7 billion gain from an increase in the amount of net unrealizedcapital gains that exist in the stocks we hold and, finally, an $11 billionloss from a write-down in the value of a few subsidiary and affiliatebusinesses that we own. All items are stated on an after-tax basis.

根据美国公认会计准则("GAAP"),伯克希尔2020年全年盈利425亿美元。由四部分组成:219亿美元的营业利润,49亿美元的资本利得,267亿美元来自我们所持有股票的未实现资本利得,最后,110亿美元的损失来自我们所拥有的一些子公司和附属公司的资产减记。以上列示数字均为税后金额。

Operating earnings are what count most, even during periods whenthey are not the largest item in our GAAP total. Our focus at Berkshireis both to increase this segment of our income and to acquire large andfavorably-situated businesses. Last year, however, we met neither goal:Berkshire made no sizable acquisitions and operating earnings fell 9%.We did, though, increase Berkshire’s per-share intrinsic value by bothretaining earnings and repurchasing about 5% of our shares.

毋容置疑,营业利润虽然在GAAP记账下并不是最大的分项,但对我们来说却是最重要的部分。伯克希尔的重点是增加这部分收入和收购大型的、处在有利位置的企业。然而过去一年这两个目标我们都没有实现:伯克希尔没有进行任何大规模的收购,经营利润也下降了9%。不过,我们通过留存收益和回购约5%的股票,的确提高了伯克希尔的每股内在价值。

The two GAAP components pertaining to capital gains or losses (whetherrealized or unrealized) fluctuate capriciously from year to year, reflectingswings in the stock market. Whatever today’s figures, Charlie Munger, mylong-time partner, and I firmly believe that, over time, Berkshire’s capitalgains from its investment holdings will be substantial.

与资本收益或亏损(无论是已实现的还是未实现的)相关的两个GAAP收益组成部分每年都会反复无常的波动,反映着股票市场的波动。无论现在的数字如何,我和我的老伙计查理·芒格都坚信,随着时间的推移,伯克希尔的投资收益将是非常可观的。

As I’ve emphasized many times, Charlie and I view Berkshire’s holdingsof marketable stocks – at yearend worth $281 billion – as a collection of businesses.We don’t control the operations of those companies, but we do shareproportionately in their long-term prosperity. From an accounting standpoint,however, our portion of their earnings is not included inBerkshire’s income. Instead, only what these investees pay us in dividends isrecorded on our books. Under GAAP, the huge sums that investees retain on ourbehalf become invisible.

正如我多次强调的那样,查理和我把伯克希尔持有的上市公司股票(截止去年底价值2810亿美元)看作一个企业集合。我们并不控制这些公司的日常运营,但我们确实按比例分享了它们股票的长期增长。然而,从会计的角度来看,我们从他们的收益中获得的部分并不被记录在伯克希尔的收入中。相反,只有这些被投资的公司支付给我们的股息才会记录在我们的账面上。根据GAAP,我们投资这些公司所得到的巨额浮盈并不会展示出来。

What’s out of sight, however, should not be out of mind: Thoseunrecorded retained earnings are usually building value – lots of value– for Berkshire. Investees use the withheld funds to expand their business,make acquisitions, pay off debt and, often, to repurchase their stock (an actthat increases our share of their future earnings). As we pointed out in thesepages last year, retained earnings have propelled American business throughoutour country’s history. What worked for Carnegie and Rockefeller has, over theyears, worked its magic for millions of shareholders as well.

然而,看不见的利润不代表不存在。这些未入账的留存收益通常为伯克希尔创造了巨大价值。被投资的公司将留存资金用于扩大业务、进行收购、偿还债务,并且经常用于回购股票(这种行为增加了我们在其未来收益中所占的份额)。正如我们去年在股东信中指出的那样,纵观美国历史,留存收益推动着许多美国企业的发展。对卡内基和洛克菲勒有效的方法,多年来也对数百万股东行之有效。

Of course, some of our investees will disappoint, adding little, ifanything, to the value of their company by retaining earnings. But others willover-deliver, a few spectacularly. In aggregate, we expect our share of thehuge pile of earnings retained by Berkshire’s non-controlled businesses (whatothers would label our equity portfolio) to eventually deliver us an equal orgreater amount of capital gains. Over our 56-year tenure, that expectation hasbeen met.

当然,我们的投资的一些企业也会让人失望,他们几乎没有通过留存收益增加公司的价值。但也有一些公司会超额完成任务,还有少数企业会有令人惊喜的表现。总而言之,我们预计伯克希尔非控股公司(即我们的股票投资组合)所留存的巨额收益中的份额,最终会为我们带来等量或更多的资本利得。在过去56年里,这一预期不断地重复实现。

The final component in our GAAP figure – that ugly $11 billionwrite-down – is almost entirely the quantification of a mistake I made in 2016.That year, Berkshire purchased Precision Castparts (“PCC”), and I paid too muchfor the company.

我们GAAP数据中的最后一个组成部分——那笔难看的110亿美元损失——几乎完全量化了我在2016年犯的一个错误。那一年,伯克希尔收购了精密机件公司(Precision Castparts,以下简称"PCC"),我为这家公司付出了太多代价。

No one misled me in any way – I was simply too optimistic about PCC’snormalized profit potential. Last year, my miscalculation was laid bare byadverse developments throughout the aerospace industry, PCC’s most importantsource of customers.

没有任何人以任何方式误导过我——我只是对PCC的潜在盈利能力过于乐观了。去年,整个航空业的不利发展暴露了我曾经的误判,而航空业是PCC最重要的客户来源。

In purchasing PCC, Berkshire bought a fine company – the best in itsbusiness. Mark Donegan, PCC’s CEO, is a passionate manager who consistentlypours the same energy into the business that he did before we purchased it. Weare lucky to have him running things.

PCC其实本质是一家不错的公司,并且是相关领域内的领头羊。PCC的首席执行官MarkDonegan是一位充满激情的管理者,与我们收购前一样,他始终如一的为公司注入了大量的精力。由他来管理公司,我们感到很放心和幸运。

I believe I was right in concluding that PCC would, over time, earn goodreturns on the net tangible assets deployed in its operations. I was wrong,however, in judging the average amount of future earnings and,consequently, wrong in my calculation of the proper price to pay for thebusiness.

我相信我的结论是正确的,即随着时间的推移,PCC将在其业务中投入的净有形资产中获得不错的回报。然而,我在判断它未来的平均收益上出现了错误预估,因此,我对PCC付出的收购价格的计算也是错误的。

PCC is far from my first error of that sort. But it’s a big one.

PCC绝不是我所犯的第一个类似错误。但这确实是个很惨痛的错误。

Two Strings to Our Bow

牵引我们的两根绳索

Berkshire is often labeled a conglomerate, a negative term applied toholding companies that own a hodge-podge of unrelated businesses. And, yes,that describes Berkshire – but only in part. To understand how and why wediffer from the prototype conglomerate, let’s review a little history.

伯克希尔经常被贴上“大型联合企业”的标签,这是一个贬义词,适用于那些拥有大量无关业务的控股公司。确实,伯克希尔拥有那么一小部分相互不相关的业务。为了说明我们与大型联合企业的不同,让我们先来回顾一下历史。

Over time, conglomerates have generally limited themselves to buyingbusinesses in their entirety. That strategy, however, came with twomajor problems. One was unsolvable: Most of the truly great businesses had nointerest in having anyone take them over. Consequently, deal-hungryconglomerateurs had to focus on so-so companies that lacked important anddurable competitive strengths. That was not a great pond in which to fish.

一直以来,大型联合企业常常局限于完整地收购一个企业。然而这种策略有两个显著问题。其中一个是无法解决的:大多数真正伟大的企业都不想让任何人接管它们。因此,渴望收购的大型联合企业们不得不把目光放在那些放在不太重要、缺乏持久竞争优势的公司上,然而在这个池塘中可钓不到大鱼。

Beyond that, as conglomerateurs dipped into this universe of mediocrebusinesses, they often found themselves required to pay staggering “control”premiums to snare their quarry. Aspiring conglomerateurs knew the answer tothis “overpayment” problem: They simply needed to manufacture a vastlyovervalued stock of their own that could be used as a “currency” for priceyacquisitions. (“I’ll pay you $10,000 for your dog by giving you two of my$5,000 cats.”)

还有一个问题是,当大型联合企业集团踏足这个充满着平庸企业的地方,他们往往发现他们需要支付惊人的由控制权产生的溢价来诱捕猎物。一些聪明的大型联合企业集团想出了解决溢价问题的方法:他们只需要自己先制造一只被大幅高估的股票,然后用股票作为 "货币 "来进行高价的收购。(这就好比,我用两只价值5000美元的猫,就可以买你价值10000美元的狗。")

Often, the tools for fostering the overvaluation of a conglomerate’sstock involved promotional techniques and “imaginative” accounting maneuversthat were, at best, deceptive and that sometimes crossed the line into fraud.When these tricks were “successful,” the conglomerate pushed its own stock to,say, 3x its business value in order to offer the target 2x its value.

通常,推高股票价值的手段包括高超的营销手段和 "富有想象力的"会计技巧,这些手段程度轻的算是骗人的把戏,程度重则会越界成为诈骗。当这些伎俩 "成功 "时,大型联合企业集团将自己的股价推高,比如说3倍于其商业价值,以便再用来收购股价2倍于自身价值的公司。

Investing illusions can continue for a surprisingly long time. WallStreet loves the fees that deal-making generates, and the press loves thestories that colorful promoters provide. At a point, also, the soaring price ofa promoted stock can itself become the “proof” that an illusion is reality.

这种假象可以持续相当长的时间。华尔街喜欢交易达成时产生的费用,媒体也喜欢公司提供的这些精彩的故事。同样,从某种程度上说,一只被推高的股票飙升的价格本身也可以成为幻想照进现实的 "证据"。

Eventually, of course, the party ends, and many business “emperors” arefound to have no clothes. Financial history is replete with the names of famousconglomerateurs who were initially lionized as business geniuses byjournalists, analysts and investment bankers, but whose creations ended up asbusiness junkyards.

当然,狂欢终会结束,当潮水褪去,我们会发现许多商业“帝王”不过是在裸泳。回顾金融史,有太多曾被记者、分析师和投资银行家誉为商业天才的著名企业家,但他们创造出来的东西最终却成了商业垃圾。

Conglomerates earned their terrible reputation.

大型联合企业集团的声誉因此声名狼藉。

************

Charlie and I want our conglomerate to own all or part of adiverse group of businesses with good economic characteristics and goodmanagers. Whether Berkshire controls these businesses, however, isunimportant to us.

查理和我希望伯克希尔是一个多元化集团,各项业务良好运转,拥有优秀的管理者。至于伯克希尔是否完全掌控这些公司,对我们来说并不那么重要。

It took me a while to wise up. But Charlie – and also my 20-yearstruggle with the textile operation I inherited at Berkshire – finallyconvinced me that owning a non-controlling portion of a wonderful business ismore profitable, more enjoyable and far less work than struggling with100% of a marginal enterprise.

我花了很长时间才意识到这一点,但查理的说服,和我在伯克希尔挣扎于纺织业务20年的经历,最终让我相信,成为一家优质公司的非控股股东远比100%控股一家边缘公司更有利可图、更享受、而且工作量少得多。

For those reasons, our conglomerate will remain a collection ofcontrolled and non-controlled businesses. Charlie and I will simplydeploy your capital into whatever we believe makes the most sense, based on acompany’s durable competitive strengths, the capabilities and character of itsmanagement, and price.

基于这些原因,伯克希尔对部分业务有控制权,而部分业务没有控制权。查理和我会根据一家公司的长期竞争优势、管理能力、特点,以及价格,把股东的资本配置到我们认为最合理的地方。

If that strategy requires little or no effort on our part, so much thebetter. In contrast to the scoring system utilized in diving competitions, youare awarded no points in business endeavors for “degree of difficulty.”Furthermore, as Ronald Reagan cautioned: “It’s said that hard work never killedanyone, but I say why take the chance?”

如果这种收购战略只需要我们很少的精力或者不需要额外付出什么努力,那就更好了。商业活动和跳水比赛不一样,不需要表演高难度动作来得分。正如罗纳德·里根(Ronald Reagan)所说的:“常常有人会说,去努力工作吧,死不了人的,但我想说的是,为什么一定要冒这个险呢?”

The Family Jewels and How We Increase Your Share of These Gems

家族“珠宝”,以及我们如何让股东的“宝石”增值

On page A-1 we list Berkshire’s subsidiaries, a smorgasbord ofbusinesses employing 360,000 at yearend. You can read much more about thesecontrolled operations in the 10-K that fills the back part of this report. Ourmajor positions in companies that we partly own and don’t control arelisted on page 7 of this letter. That portfolio of businesses, too, is largeand diverse.

在A-1页,我们列出了伯克希尔的子公司们,这些公司截止去年末拥有36万名员工。您可以在本报告后面的10-K报告中阅读更多具体信息。本报告第7页列出了我们拥有部分股权但不控股的公司,我们这种业务组合当然也是非常庞大且多样化的。

Most of Berkshire’s value, however, resides infour businesses, three controlled and one in which we have only a 5.4%interest. All four are jewels.

然而,伯克希尔的大部分价值在于四家公司,其中三家由我们控股,一家我们只拥有5.4%的股权。这四家我们都视作珍宝。

The largest in value is our property/casualty insurance operation, whichfor 53 years has been the core of Berkshire. Our family of insurers is uniquein the insurance field. So, too, is its manager, Ajit Jain, who joinedBerkshire in 1986.

价值最大的是我们的财产/意外伤害保险业务,53年来一直是伯克希尔的核心业务。我们的保险公司集团在保险领域是独一无二的。他们的经理Ajit Jain也是如此,他早在1986年就加入了伯克希尔。

Overall, the insurance fleet operates with far more capital thanis deployed by any of its competitors worldwide. That financial strength,coupled with the huge flow of cash Berkshire annually receives from its non-insurancebusinesses, allows our insurance companies to safely follow an equity-heavyinvestment strategy not feasible for the overwhelming majority of insurers.Those competitors, for both regulatory and credit-rating reasons, must focuson bonds.

总的来说,伯克希尔保险公司这艘“航母”运营的资金远远超过全球任何竞争对手。这种财务实力,再加上伯克希尔每年从非保险业务中获得的巨额现金流,使我们的保险公司集团能够安全地遵循以股权投资为主的策略,而这对绝大多数保险公司来说是不可行的。出于监管和信用评级的原因,绝大多数竞争对手只能将重点放在债券投资上。

And bonds are not the place to be these days. Can you believethat the income recently available from a 10-year U.S. Treasury bond – theyield was 0.93% at yearend – had fallen 94% from the 15.8% yieldavailable in September 1981? In certain large and important countries, such asGermany and Japan, investors earn a negative return on trillions ofdollars of sovereign debt. Fixed-income investors worldwide – whether pensionfunds, insurance companies or retirees – face a bleak future.

然而,现阶段债券并不是个好的投资方向。你能相信最近10年期美国国债的收益率(2020年末收益率仅为0.93%)比1981年9月的15.8%下降了94%吗?在某些主要的大国,如德国和日本,投资者在数万亿美元的主权债务中获得的甚至是负数。全世界的债券投资者——无论是养老基金、保险公司还是退休金——都面临着惨淡的未来。

Some insurers, as well as other bond investors, may try to juice thepathetic returns now available by shifting their purchases to obligationsbacked by shaky borrowers. Risky loans, however, are not the answer toinadequate interest rates. Three decades ago, the once-mighty savings and loanindustry destroyed itself, partly by ignoring that maxim.

一些保险公司,以及其他债券投资者,可能会试图转向购买高风险发行人的债券来提高他们现在少的可怜的回报率。然而,投资高风险公司债并不是解决利率不足的办法。三十年前,很多曾经辉煌一时的储蓄和贷款行业最终毁灭了,部分原因是忽视了这条箴言。

Berkshire now enjoys $138 billion of insurance “float” – funds that donot belong to us, but are nevertheless ours to deploy, whether in bonds, stocksor cash equivalents such as U.S. Treasury bills. Float has some similarities tobank deposits: cash flows in and out daily to insurers, with the total theyhold changing very little. The massive sum held by Berkshire is likely toremain near its present level for many years and, on a cumulative basis, hasbeen costless to us. That happy result, of course, could change – but,over time, I like our odds.

伯克希尔现在拥有1380亿美元的保险“浮存金”--这些资金不属于我们,但我们可以进行调配,无论是债券、股票还是美国国库券等现金等价物。浮存金与银行存款有一些相似之处:保险公司的现金流每天进出,而保险公司所持有的现金总量变化不大。伯克希尔持有的巨额资金可能会在很多年内保持在目前的水平,而且从累积的角度看,这对我们而言一直都没有成本。当然,这个令人高兴的结论可能会改变,但随着时间的推移,我喜欢我们现在拥有的胜算。

I have repetitiously – some might say endlessly – explained ourinsurance operation in my annual letters to you. Therefore, I will this yearask new shareholders who wish to learn more about our insurance business and“float” to read the pertinent section of the 2019 report, reprinted on pageA-2. It’s important that you understand the risks, as well as theopportunities, existing in our insurance activities.

在我每年给你们的信中,我已经反复地 —— 或许有些人可能会说没完没了地—— 解释了我们的保险业务。因此,今年请想了解更多我们保险业务和“浮存金”的新股东阅读2019年报告的相关部分,该报告刊载于A-2页。了解我们保险活动中存在的风险和机遇是很重要的。

Our second and third most valuable assets – it’s pretty much a toss-upat this point – are Berkshire’s 100% ownership of BNSF, America’s largestrailroad measured by freight volume, and our 5.4% ownership of Apple. And inthe fourth spot is our 91% ownership of Berkshire Hathaway Energy (“BHE”). Whatwe have here is a very unusual utility business, whose annual earnings havegrown from $122 million to $3.4 billion during our 21 years ofownership.

我们第二和第三大最有价值的资产是伯克希尔对按货运量衡量美国最大的铁路公司BNSF的100%持股,以及我们对苹果公司5.4%的持股。排名第四的是我们持有91%的伯克希尔哈撒韦能源公司(BHE)。这是一个非常不同寻常的公共事业公司,在我们拥有它的21年里,它的年收入从1.22亿美元增长到了34亿美元。

I’ll have more to say about BNSF and BHE later in this letter. For now,however, I would like to focus on a practice Berkshire will periodically use toenhance your interest in both its “Big Four” as well as the many otherassets Berkshire owns.

关于BNSF和BHE在这封信后面我将做更多说明。然而现在,我想重点谈谈伯克希尔定期使用的一种做法,以提高你对它的“四大资产”以及伯克希尔拥有的许多其他资产的兴趣。

Last year we demonstrated our enthusiasm for Berkshire’s spread ofproperties by repurchasing the equivalent of 80,998 “A” shares, spending $24.7billion in the process. That action increased your ownership in all ofBerkshire’s businesses by 5.2% without requiring you to so much as touchyour wallet.

去年,我们花247亿美元回购了相当于80998股伯克希尔哈撒韦A股的股票,这表明了我们对伯克希尔的热情。这一行动使你们在伯克希尔旗下所有企业的持股比例增加了5.2%,而你甚至不必动自己的账户。

Following criteria Charlie and I have long recommended, we made thosepurchases because we believed they would both enhance the intrinsic value pershare for continuing shareholders and would leave Berkshire with morethan ample funds for any opportunities or problems it might encounter.

按照查理和我长期以来的标准,我们进行了这些回购,因为我们相信,这些回购既能提高股东的每股内在价值,也能让伯克希尔拥有充足的资金来应对可能遇到的任何机会或问题。

In no way do we think that Berkshire shares should be repurchased atsimply any price. I emphasize that point because American CEOs have anembarrassing record of devoting more company funds to repurchases when priceshave risen than when they have tanked. Our approach is exactly the reverse.

我们绝不认为伯克希尔的股票应该以任何价格回购。我之所以强调这一点,是因为美国上市公司的CEO们有过这样一个尴尬的记录:在股价上涨时,他们投入更多公司资金用于回购,而不是股价下跌时。但我们的做法恰恰相反。

Berkshire’s investment in Apple vividly illustrates the power ofrepurchases. We began buying Apple stock late in 2016 and by early July 2018,owned slightly more than one billion Apple shares (split-adjusted). Sayingthat, I’m referencing the investment held in Berkshire’s general account and amexcluding a very small and separately-managed holding of Apple shares that wassubsequently sold. When we finished our purchases in mid-2018, Berkshire’sgeneral account owned 5.2% of Apple.

伯克希尔对苹果的投资生动地说明了回购的力量。我们从2016年末开始购买苹果股票,到2018年7月初,我们持有的苹果股票(经拆股调整后)略多于10亿股。这里我指的是伯克希尔总分类账户中持有的投资,而不包括随后售出的一笔非常小的单独管理的苹果股票。当我们在2018年年中完成购买时,伯克希尔的总分类账户持有苹果5.2%的股份。

Our cost for that stake was $36 billion. Since then, we have bothenjoyed regular dividends, averaging about $775 million annually, and have also– in 2020 – pocketed an additional $11 billion by selling a small portion ofour position.

我们的投资成本是360亿美元。从那以后,我们都享受了定期股息,平均每年约7.75亿美元,而且在2020年,通过出售一小部分头寸,我们还获得了额外的110亿美元。

Despite that sale – voila! – Berkshire now owns 5.4% of Apple. Thatincrease was costless to us, coming about because Apple has continuouslyrepurchased its shares, thereby substantially shrinking the number it now hasoutstanding.

尽管有卖了一部分—— 你们瞧瞧!——伯克希尔目前仍持有苹果5.4%的股份。这一增长对我们来说是没有成本的,因为苹果一直在回购其股票,从而大大减少了它现在的流通股数量。

But that’s far from all of the good news. Because we also repurchased Berkshireshares during the 21⁄2 years, you now indirectly own a full 10% more ofApple’s assets and future earnings than you did in July 2018.

好消息可不止于此。因为我们在两年半内还回购了伯克希尔的股票,你现在间接拥有的苹果资产和未来收益比2018年7月整整多10%。

This agreeable dynamic continues. Berkshire has repurchased more sharessince yearend and is likely to further reduce its share count in the future.Apple has publicly stated an intention to repurchase its shares as well. Asthese reductions occur, Berkshire shareholders will not only own a greaterinterest in our insurance group and in BNSF and BHE, but will also find theirindirect ownership of Apple increasing as well.

这种令人愉快的动态收益仍在继续。伯克希尔自去年底以来回购了更多股票,并且将来可能会进一步减少其股票数量。苹果也公开表示有意回购其股票。随着流通股的减少,伯克希尔的股东不仅将在我们的保险集团、BNSF(美国伯灵顿北方圣太菲铁路运输公司)和BHE(伯克希尔·哈撒韦能源公司)中拥有更大的利益,而且还会发现他们对苹果的间接所有权也在增加。

The math of repurchases grinds away slowly, but can be powerful overtime. The process offers a simple way for investors to own an ever-expandingportion of exceptional businesses.

回购的过程在数学上看似很缓慢,但随着时间的推移,收益会变得很丰厚。该过程为投资者提供了一种简单的方式,让他们拥有不断扩大的企业份额。

And as a sultry Mae West assured us: “Too much of a good thing can be .. . wonderful.”

正如性感女星梅·韦斯特(Mae West)向我们保证的那样:“好东西多多益善”。

Investments

投资

Below we list our fifteen common stock investments that at yearend wereour largest in market value. We exclude our Kraft Heinz holding — 325,442,152shares — because Berkshire is part of a control group and therefore mustaccount for that investment using the “equity” method. On its balance sheet,Berkshire carries the Kraft Heinz holding at a GAAP figure of $13.3 billion, anamount that represents Berkshire’s share of the audited net worth of KraftHeinz on December 31, 2020. Please note, though, that the market value of ourshares on that date was only $11.3 billion.

下面我们列出了我们在截至去年年末市值最大的15项普通股投资。我们排除了公司持有的325442152股卡夫亨氏,因为伯克希尔是控股集团的一部分,因此必须使用“权益”法对这笔投资进行核算。在他们的资产负债表上,伯克希尔在GAAP计算下持有卡夫亨氏的股份价值为133亿美元,代表着伯克希尔在卡夫亨氏截至2020年12月31日经审计净资产中所占的份额。不过请注意,当时我们的股票市值只有113亿美元。

* Excludes shares held by pension funds of Berkshire subsidiaries.

** This is our actual purchase price and also our tax basis.

*** Includes a $10 billion investment in Occidental Petroleum, consisting ofpreferred stock and warrants to buy common stock, a combination now beingvalued at $9 billion.

*不包括伯克希尔养老基金子公司持有的股份。

**这是我们的实际购买价格,也是我们的计税依据。

***包括对西方石油公司(OccidentalPetroleum)的100亿美元投资,包括优先股和用于购买普通股的认股权证,目前组合估值为90亿美元。

A Tale of Two Cities

"双城记"

Success stories abound throughout America. Since our country’s birth,individuals with an idea, ambition and often just a pittance of capital havesucceeded beyond their dreams by creating something new or by improving thecustomer’s experience with something old.

在美国,成功的故事比比皆是。自美国诞生以来,那些有理想、有抱负,却往往只有微薄资本的人,通过创造新东西或用旧东西改善顾客体验,取得了超出他们梦想的成功。

Charlie and I journeyed throughout the nation to join with many of theseindividuals or their families. On the West Coast, we began the routine in 1972with our purchase of See’s Candy. A full century ago, Mary See set out todeliver an age-old product that she had reinvented with special recipes. Addedto her business plan were quaint stores staffed by friendly salespeople. Herfirst small outlet in Los Angeles eventually led to several hundred shops,spread throughout the West.

查理和我曾游历全美,与这些人或他们的家人相遇。在西海岸,我们从1972年收购喜诗糖果(See’sCandy)开始了这一惯例。整整一个世纪前,玛丽·时思(Mary See)开始推出一种古老的产品,她用特殊的配方对其进行了改造。除了她的商业计划之外,她还开设了一些古色古香的商店,里面有态度友好的销售人员。她在洛杉矶开的第一家小专卖店最终发展成了几百家商店,遍布整个西部地区。

Today, Mrs. See’s creations continue to delight customers whileproviding life-long employment for thousands of women and men. Berkshire’s jobis simply not to meddle with the company’s success. When a businessmanufactures and distributes a non-essential consumer product, the customer isthe boss. And, after 100 years, the customer’s message to Berkshire remainsclear: “Don’t mess with my candy.” (The website ishttps://www.sees.com/; try the peanut brittle.)

今天,See女士的产品依旧吸引着客户,同时为成千上万的男女提供终身就业机会。伯克希尔的工作就是不干涉公司的成功。当企业生产和分销一种非必需的消费品时,顾客就是老板。100年后,顾客向伯克希尔传递的信息依然明确:“不要乱动我的糖果。”(喜诗糖果的网址是 https://www.sees.com/,可以试试他们的花生糖。)

Let’s move across the continent to Washington, D.C. In 1936, LeoGoodwin, along with his wife, Lillian, became convinced that auto insurance – astandardized product customarily purchased from agents – could be sold directlyat a much lower price. Armed with $100,000, the pair took on giant insurerspossessing 1,000 times or more their capital. Government Employees InsuranceCompany (later shortened to GEICO) was on its way.

接下来让我们跨越大陆来到华盛顿特区。1936年,利奥·古德温(Leo Goodwin)和他的妻子莉莲(Lillian)开始相信,汽车保险——一种通常从代理商那里购买的标准化产品——可以直接以低得多的价格出售。两人怀揣10万美元,与拥有1000倍甚至更庞大资本的大型保险公司展开了较量。政府员工保险公司(后来简称为GEICO)由此开始了其漫漫征程。

By luck, I was exposed to the company’s potential a full 70 years ago.It instantly became my first love (of an investment sort). You know the rest ofthe story: Berkshire eventually became the 100% owner of GEICO, which at 84years of age is constantly fine-tuning – but not changing – the vision of Leoand Lillian.

幸运的是,我在整整70年前就意识了这家公司的潜力。它立刻成为了我的初恋(在投资方面)。接下来的故事大家都知道了:伯克希尔最终100%拥有了GEICO,这家84岁年历史公司一直在各种调整,但没有改变利Leo和Lillian当初的愿景。

There has been, however, a change in the company’s size. In 1937, itsfirst full year of operation, GEICO did $238,288 of business. Last year thefigure was $35 billion.

当然,该公司的规模发生了变化。1937年,也就是GEICO运营的第一个整年,它完成了238288美元的业务。去年的数字是350亿美元。

************

Today, with much of finance, media, government and tech located incoastal areas, it’s easy to overlook the many miracles occurring in middleAmerica. Let’s focus on two communities that provide stunning illustrations ofthe talent and ambition existing throughout our country.

如今,许多金融、媒体、政府和科技机构都位于沿海地区,人们很容易忽视美国中部发生的许多奇迹。让我们聚焦两个区域,它们为美国全国各地的人才和雄心提供了令人惊叹的例证。

You will not be surprised that I begin with Omaha.

你将不会惊讶于我从奥马哈开始。

In 1940, Jack Ringwalt, a graduate of Omaha’s Central High School (thealma mater as well of Charlie, my dad, my first wife, our three children andtwo grandchildren), decided to start a property/casualty insurance companyfunded by $125,000 in capital.

1940年,毕业于奥马哈中心高中(也是查理、我父亲、我第一任妻子、我们的三个孩子和两个孙儿的母校)的杰克·林格沃特(Jack Ringwalt)决定用12.5万美元的资本创办一家财产/意外保险公司。

Jack’s dream was preposterous, requiring his pipsqueak operation –somewhat pompously christened as National Indemnity – to compete with giantinsurers, all of which operated with abundant capital. Additionally, thosecompetitors were solidly entrenched with nationwide networks of well-funded andlong-established local agents. Under Jack’s plan, National Indemnity, unlikeGEICO, would itself use whatever agencies deigned to accept it and consequentlyenjoy no cost advantage in its acquisition of business. To overcomethose formidable handicaps, National Indemnity focused on “odd-ball” risks,which were deemed unimportant by the “big boys.” And, improbably, the strategysucceeded.

杰克的梦想似乎是荒谬的,因为这要求他的小公司——有点夸张地被命名为国民保险公司(NationalIndemnity)——要与大型保险公司竞争,而这些公司都拥有充足的资本。此外,这些竞争对手凭借遍布全国、资金雄厚、历史悠久的当地代理商网络而牢固地确立了自己的地位。在杰克的计划中,与GEICO不同的是,国民保险公司本身将会使用任何屈尊接受它的机构,因此在收购业务时没有成本优势。为了克服这些可怕的障碍,国民保险将重点放在了被大公司认为不重要的“古怪”风险上。不可思议的是,这一策略出人意料地成功了。

Jack was honest, shrewd, likeable and a bit quirky. In particular, he dislikedregulators. When he periodically became annoyed with their supervision, hewould feel an urge to sell his company.

杰克诚实、精明、讨人喜欢,还有点古怪。他尤其不喜欢监管机构。每当他对他们的监督感到厌烦时,他就会有卖掉公司的冲动。

Fortunately, I was nearby on one of those occasions. Jack liked the ideaof joining Berkshire, and we made a deal in 1967, taking all of 15 minutes toreach a handshake. I never asked for an audit.

幸运的是,有一次我就在附近。杰克想加入伯克希尔,于是我们在1967年达成了交易,只用了15分钟就达成了协议。我都从没要求过账目审计。

Today National Indemnity is the only company in the world preparedto insure certain giant risks. And, yes, it remains based in Omaha, a few milesfrom Berkshire’s home office.

今天,国民保险公司是世界上唯一一家愿意为某些巨大风险承保的公司。是的,它的总部仍然在奥马哈,距离伯克希尔的总部只有几英里。

Over the years, we have purchased four additional businesses from Omahafamilies, the best known among them being Nebraska Furniture Mart (“NFM”). Thecompany’s founder, Rose Blumkin (“Mrs. B”), arrived in Seattle in 1915 as aRussian emigrant, unable to read or speak English. She settled in Omaha severalyears later and by 1936 had saved $2,500 with which to start a furniture store.

多年来,我们又从奥马哈地区收购了四家企业,其中最著名的是内布拉斯加州家具城(NFM)。该公司的创始人罗斯·布卢姆金(Rose Blumkin,B夫人)是俄罗斯移民,在1915年来到西雅图,她既不会读也不会说英语。几年后,她定居在奥马哈。在1936年,她攒下了2500美元,用这笔钱开了一家家具店。

Competitors and suppliers ignored her, and for a time their judgmentseemed correct: World War II stalled her business, and at yearend 1946, thecompany’s net worth had grown to only $72,264. Cash, both in the till and ondeposit, totaled $50 (that’s not a typo).

竞争对手和供应商忽视了她,而他们的判断在当时无疑是正确的:第二次世界大战让她的生意停滞了。1946年底,公司的净资产仅增长到72264美元。现金只有50美元(没有打错字)。

One invaluable asset, however, went unrecorded in the 1946 figures:Louie Blumkin, Mrs. B’s only son, had rejoined the store after four years inthe U.S. Army. Louie fought at Normandy’s Omaha Beach following the D-Dayinvasion, earned a Purple Heart for injuries sustained in the Battle of theBulge, and finally sailed home in November 1945.

然而,有一笔无价的财富没有在1946年的数字中记录下来:B夫人唯一的儿子路易·布卢姆金(Louie Blumkin)在美国军队服役四年后重新加入了这家店。在诺曼底登陆后,路易参加了诺曼底奥马哈海滩的战斗,并因在Bulge战役中受伤而获得了紫心勋章,最终在1945年11月乘船回国。

Once Mrs. B and Louie were reunited, there was no stopping NFM. Drivenby their dream, mother and son worked days, nights and weekends. The result wasa retailing miracle.

一旦B夫人和路易重聚,就没有什么能阻止这家家具店的发展了。在梦想的驱使下,母亲和儿子不分昼夜地工作。结果是他们创造了一个零售业奇迹。

By 1983, the pair had created a business worth $60 million. That year,on my birthday, Berkshire purchased 80% of NFM, again without an audit. Icounted on Blumkin family members to run the business; the third and fourthgeneration do so today. Mrs. B, it should be noted, worked daily until she was103 – a ridiculously premature retirement age as judged by Charlie and me.

到1983年,两人已经让家具店的业务规模达到了6000万美元。那一年,在我生日那天,伯克希尔收购了NFM 80%的股份。同样,我们没有对这家家具店进行审计。我指望布卢姆金的家族成员来经营企业。今天,NFM正由第三代和第四代布卢姆金的家族成员管理着。需要指出的是,B夫人每天都在工作,直到103岁——在我和查理看来,要说在这个年纪退休,那可早的太荒谬了。

NFM now owns the three largest home-furnishings stores in the U.S. Eachset a sales record in 2020, a feat achieved despite the closing of NFM’s storesfor more than six weeks because of COVID-19.

NFM目前拥有美国最大的三家家居用品商店,尽管NFM的门店因为新冠疫情关闭了六周多,但这三家商店在2020年都创下了销售记录。

A post-script to this story says it all: When Mrs. B’s large familygathered for holiday meals, she always asked that they sing a song beforeeating. Her selection never varied: Irving Berlin’s “God Bless America.”

这个故事的后记说明了一切:每当B夫人的一大家子人聚在一起过节吃饭时,她总是要求他们在吃饭前唱首歌。她的选择从未改变过:欧文·柏林(Irving Berlin)的《上帝保佑美国》(God Bless America)。

************

Let’s move somewhat east to Knoxville, the third largest city in Tennessee.There, Berkshire has ownership in two remarkable companies – ClaytonHomes (100% owned) and Pilot Travel Centers (38% owned now, but headed for 80%in 2023).

让我们向东转移到田纳西州的第三大城市诺克斯维尔。在那里,伯克希尔拥有两家引人注目的公司——克莱顿住宅(ClaytonHomes)(100%持股)和Pilot Travel Centers(目前持股38%,但到2023年将达到80%)。

Each company was started by a young man who had graduated from theUniversity of Tennessee and stayed put in Knoxville. Neither had a meaningfulamount of capital nor wealthy parents.

每一家公司都是由一位毕业于田纳西大学并留在诺克斯维尔的年轻人创立的。这两个年轻人都没有足够的资金,父母也不富裕。

But, so what? Today, Clayton and Pilot each have annual pre-taxearnings of more than $1 billion. Together they employ about 47,000 menand women.

但是,那又怎样?如今,克莱顿和Pilot的年税前利润都超过了10亿美元。这两家公司共雇用了大约4.7万名员工。

Jim Clayton, after several other business ventures, founded ClaytonHomes on a shoestring in 1956, and “Big Jim” Haslam started what became PilotTravel Centers in 1958 by purchasing a service station for $6,000. Each of themen later brought into the business a son with the same passion, values andbrains as his father. Sometimes there is a magic to genes.

吉姆-克莱顿(Jim Clayton)在经历了几次商业冒险之后,于1956年以小本经营的方式创建了克莱顿住宅(ClaytonHomes)。1958年,“大个子吉姆”(Big Jim Haslam)以6000美元的价格购买了一个服务站,创建了后来的Pilot Travel Centers。后来,他俩的儿子也都加入了他们的父亲的公司,他们的儿子有着和他们父亲一样的激情、价值观和头脑。有时候基因太有魔力了。

“Big Jim” Haslam, now 90, has recently authored an inspirational book inwhich he relates how Jim Clayton’s son, Kevin, encouraged the Haslams tosell a large portion of Pilot to Berkshire. Every retailer knows that satisfiedcustomers are a store’s best salespeople. That’s true when businesses arechanging hands as well.

现年90岁的“大吉姆”Haslam最近写了一本励志书,他在书中讲述了JimClayton的儿子Kevin是如何鼓励Haslam家族将大部分的PilotTravel Centers卖给伯克希尔的。每个零售商都知道满意的顾客是商店的最佳销售人员。当企业易手时也是如此。

************

When you next fly over Knoxville or Omaha, tip your hat to the Claytons,Haslams and Blumkins as well as to the army of successful entrepreneurs whopopulate every part of our country. These builders needed America’s frameworkfor prosperity – a unique experiment when it was crafted in 1789 – to achievetheir potential. In turn, America needed citizens like Jim C., Jim H., Mrs. Band Louie to accomplish the miracles our founding fathers sought.

当您下次飞越诺克斯维尔或奥马哈时,请向Clayton家族、Haslam家族和Blumkin家族,以及遍布全国各地的成功企业家们脱帽致敬吧。这些创造者需要美国的繁荣框架(它始于1789年进行的一次独特实验)来实现他们的潜力。反过来,美国需要像吉姆·C、吉姆·H、布卢姆金夫人和路易这样的公民来实现开国元勋所追求的奇迹。

Today, many people forge similar miracles throughout the world,creating a spread of prosperity that benefits all of humanity. In itsbrief 232 years of existence, however, there has been no incubator forunleashing human potential like America. Despite some severe interruptions, ourcountry’s economic progress has been breathtaking.

如今,许多人在世界各地创造了类似的奇迹,创造了使全人类受益的繁荣。然而,在短暂的232年历史中,还没有一个像美国这样释放人类潜能的孵化器。尽管出现了严重的中断,但我们国家的经济发展一直是惊人的。

Beyond that, we retain our constitutional aspiration of becoming “a moreperfect union.” Progress on that front has been slow, uneven and oftendiscouraging. We have, however, moved forward and will continue to do so.

除此之外,我们仍保留宪法所赋予我们成为“一个更完美的联邦”的愿望。在这方面的进展是缓慢的、不平衡且经常令人沮丧。但是,我们已经向前迈进,并将继续前进。

Our unwavering conclusion: Never bet against America.

我们坚定不移的结论:永远不要和美国对赌。

The Berkshire Partnership

伯克希尔伙伴关系

Berkshire is a Delaware corporation, and our directors must follow thestate’s laws. Among them is a requirement that board members must act inthe best interest of the corporation and its stockholders. Our directorsembrace that doctrine.

伯克希尔是特拉华州的一家公司,我们的董事必须遵守该州的法律。其中一项要求是,董事会成员必须以公司及其股东的最佳利益为出发点。我们的董事们拥护这一原则。

In addition, of course, Berkshire directors want the company to delightits customers, to develop and reward the talents of its 360,000 associates, tobehave honorably with lenders and to be regarded as a good citizen of the manycities and states in which we operate. We value these four importantconstituencies.

此外,伯克希尔的董事们当然也希望公司能取悦客户,培养和奖励36万名员工的才能,与贷款机构保持良好的关系,并在许多我们运营业务的城市和州被视为良好公民。我们重视这四个重要的群体。

None of these groups, however, have a vote in determining suchmatters as dividends, strategic direction, CEO selection, or acquisitions anddivestitures. Responsibilities like those fall solely on Berkshire’sdirectors, who must faithfully represent the long-term interests of thecorporation and its owners.

然而这些团体中,没有任何一个团体在确定诸如股息、战略方向,首席执行官人选、并购和资产剥离之类的事情上有投票权。这些方面的责任完全是伯克希尔公司董事们的责任,他们必须忠实地代表公司及其所有者的长期利益。

Beyond legal requirements, Charlie and I feel a special obligation tothe many individual shareholders of Berkshire. A bit of personal historymay help you to understand our unusual attachment and how it shapes ourbehavior.

除了法律要求之外,查理和我觉得对伯克希尔的许多个人股东负有特殊的义务。在这里,我谈一点个人经历,可能会帮助您了解我们不寻常的关系,以及它是如何塑造我们的行为的。

************

Before my Berkshire years, I managed money for many individuals througha series of partnerships, the first three of those formed in 1956. As timepassed, the use of multiple entities became unwieldy and, in 1962, we amalgamated12 partnerships into a single unit, Buffett Partnership Ltd. (“BPL”).

在我执掌伯克希尔之前,我通过一系列的合伙人公司关系为许多人管理资金,头三个是1956年建立的。随着时间的推移,同时运营多个实体变得难以控制,在1962年,我们将12个合伙企业合并为一个独立的实体,即巴菲特合伙有限公司(Buffett Partnership Ltd.“ BPL”)。

By that year, virtually all of my own money, and that of my wife aswell, had become invested alongside the funds of my many limited partners. Ireceived no salary or fees. Instead, as the general partner, I was compensatedby my limited partners only after they secured returns above an annualthreshold of 6%. If returns failed to meet that level, the shortfall was to becarried forward against my share of future profits. (Fortunately, that neverhappened: Partnership returns always exceeded the 6% “bogey.”) As the yearswent by, a large part of the resources of my parents, siblings, aunts, uncles,cousins and in-laws became invested in the partnership.

到了那一年,我自己的钱,我妻子的钱,几乎都和我许多有限合伙人企业的基金一起投资了。我没有收取薪水或费用。相反,作为普通合伙人,我的有限合伙人只有在确保回报率高于6%的年度门槛后,如果收益未能达到该水平,差额部分就从我未来的应得利润中扣除。(幸运的是,从未发生过这种事:合伙人回报率总是超过6%的“标准杆”。)随着岁月的流逝,我父母、兄弟姐妹、姨妈姑婶、叔叔舅舅、表兄弟和姻亲都将大部分资金投资给了上述合伙企业。

Charlie formed his partnership in 1962 and operated much as I did.Neither of us had any institutional investors, and very few of ourpartners were financially sophisticated. The people who joined our venturessimply trusted us to treat their money as we treated our own. These individuals– either intuitively or by relying on the advice of friends – correctlyconcluded that Charlie and I had an extreme aversion to permanent loss ofcapital and that we would not have accepted their money unless we expected todo reasonably well with it.

查理在1962年成立了合伙公司,运作方式和我差不多。我们都没有任何机构投资者,我们的合作伙伴中也很少有金融行家。那些加入我们公司的人相信我们会像对待自己的钱一样对待他们的钱。这些人——要么凭直觉,要么依靠朋友们的建议——正确地得出了这样的结论:查理和我对资本的永久亏损有着极端的厌恶,除非我们预期他们的钱会做得相当不错,否则我们不会接受他们的钱。

I stumbled into business management after BPL acquired control ofBerkshire in 1965. Later still, in 1969, we decided to dissolve BPL. Afteryearend, the partnership distributed, pro-rata, all of its cash along withthree stocks, the largest by value being BPL’s 70.5% interest in Berkshire.

1965年BPL收购伯克希尔哈撒韦的控制权后,我无意中进入了企业管理领域。后来,在1969年,我们决定解散BPL。年底后,这家合伙企业按比例分配了所有现金和三支股票,其中价值最高的是BPL在伯克希尔哈撒韦的70.5%股权。

Charlie, meanwhile, wound up his operation in 1977. Among the assets hedistributed to partners was a major interest in Blue Chip Stamps, a company hispartnership, Berkshire and I jointly controlled. Blue Chip was also among thethree stocks my partnership had distributed upon its dissolution.

与此同时,查理在1977年结束了其公司的运营。在他分配给合伙人的资产中,包括Blue Chip Stamps的主要股份,这是他的合伙人、伯克希尔和我共同控制的一家公司。Blue Chip也是我的合伙公司解散时分配的三支股票之一。

In 1983, Berkshire and Blue Chip merged, thereby expanding Berkshire’sbase of registered shareholders from 1,900 to 2,900. Charlie and I wantedeveryone – old, new and prospective shareholders – to be on the samepage.

1983年,伯克希尔和Blue Chip合并,使伯克希尔的注册股东基础从1900人扩大到2900人。查理和我希望所有人——新老股东和潜在股东——都能步调一致达成共识。

Therefore, the 1983 annual report – up front – laid out Berkshire’s“major business principles.” The first principle began: “Although ourform is corporate, our attitude is partnership.” That defined our relationshipin 1983; it defines it today. Charlie and I – and our directors as well –believe this dictum will serve Berkshire well for many decades to come.

因此,在1983年的年度报告中,伯克希尔提出了“主要商业原则”。第一个原则:“虽然我们的形式是公司,但我们的态度是合作伙伴关系。”这一点在1983年定义了我们的关系;它还定义了公司的今天。查理和我——还有我们的董事们——相信,这句格言将在未来几十年都会很好地为伯克希尔服务。

************

Ownership of Berkshire now resides in five large “buckets,” one occupied by meas a “founder” of sorts. That bucket is certain to empty as the shares I ownare annually distributed to various philanthropies.

伯克希尔的所有权现在分布于五个大的“桶”里,其中一个被我作为“创始人”占据着。我这“桶”肯定是空的,因为我拥有的股份每年都会分配给各种慈善机构。

Two of the remaining four buckets are filled by institutional investors,each handling other people’s money. That, however, is where thesimilarity between those buckets ends: Their investing procedures could not bemore different.

其余四桶中有两桶由机构投资者占据,各自负责管理他人的资金。然而,这就是这两个桶之间的不同之处:它们的投资程序截然不同。

In one institutional bucket are index funds, a large and mushroomingsegment of the investment world. These funds simply mimic the index that theytrack. The favorite of index investors is the S&P 500, of which Berkshireis a component. Index funds, it should be emphasized, own Berkshire sharessimply because they are required to do so. They are on automatic pilot,buying and selling only for “weighting” purposes.

一个机构类型是指数基金,这是投资界一个规模庞大、迅速发展的领域。这些基金只是紧贴它们追踪的指数。指数投资者最喜欢的是标普500指数(S&P 500),伯克希尔哈撒韦是该指数的成份股。应该强调的是,指数基金持有伯克希尔股票的原因很简单,因为它们必须这样做。他们纯粹是“自动驾驶”,买卖股票唯一的目的就是调整“权数”。

In the other institutional bucket are professionals who manage theirclients’ money, whether those funds belong to wealthy individuals,universities, pensioners or whomever. These professional managers have amandate to move funds from one investment to another based on their judgment asto valuation and prospects. That is an honorable, though difficult, occupation.

另一个机构类型则是管理客户资金的专业人士,不管这些资金属于富人、大学、退休人员或任何人。这些职业经理人的职责是根据他们对估值和前景的判断,将资金从一项投资转移到另一项投资。这是一个光荣而艰难的职业。

We are happy to work for this “active” group, while they meanwhilesearch for a better place to deploy the funds of their clientele. Somemanagers, to be sure, have a long-term focus and trade very infrequently.Others use computers employing algorithms that may direct the purchase or saleof shares in a nano-second. Some professional investors will come and go basedupon their macro-economic judgments.

我们很高兴为这个“活跃的”团体工作,同时他们也在寻找更好的地方来配置客户资金。可以肯定的是,一些基金经理着眼长远,交易频率很低。还有一些人使用计算机,利用算法可以在一纳秒内指导股票的买卖。一些专业投资者会根据他们对宏观经济的判断来调整仓位。

Our fourth bucket consists of individual shareholders who operate in amanner similar to the active institutional managers I’ve just described. Theseowners, understandably, think of their Berkshire shares as a possible source offunds when they see another investment that excites them. We have no quarrelwith that attitude, which is similar to the way we look at some of theequities we own at Berkshire.

第四类是个人股东,他们的运作方式与我刚才描述的积极型机构经理人类似。可以理解的是,当这些股东看到另一项令他们兴奋的投资时,他们会把自己持有的伯克希尔股票视为可能的资金来源(因而卖出伯克希尔股票)。我们对这种态度没有异议,这与我们看待伯克希尔一些股票的方式类似。

All of that said, Charlie and I would be less than human if we did notfeel a special kinship with our fifth bucket: the million-plus individual investorswho simply trust us to represent their interests, whatever the future maybring. They have joined us with no intent to leave, adopting a mindset similarto that held by our original partners. Indeed, many investors from our partnershipyears, and/or their descendants, remain substantial owners of Berkshire.

综上所述,如果查理和我对我们的第五桶没有特别的亲缘感,那我们就没有人性了。第五桶就是超过百万的个人投资者们,他们相信我们会代表他们的利益,不管未来会发生什么。他们加入我们并不打算离开,他们的心态与我们最初的合作伙伴相似。事实上,在我们合伙期间的许多投资者,以及/或他们的后代,仍然是伯克希尔的主要股东。

A prototype of those veterans is Stan Truhlsen, a cheerful and generousOmaha ophthalmologist as well as personal friend, who turned 100 on November13, 2020. In 1959, Stan, along with 10 other young Omaha doctors, formed apartnership with me. The docs creatively labeled their venture Emdee, Ltd.Annually, they joined my wife and me for a celebratory dinner at our home.

斯坦·特鲁尔森(Stan Truhlsen)就是这些“老合作伙伴”的一个典型代表,他是奥马哈市一位开朗慷慨的眼科医生,我们私下也有交情。他在2020年11月13日迎来了自己的100岁生日。1959年,斯坦和其他10名年轻的奥马哈医生与我结成了伙伴关系。他们创造性地将自己的公司命名为Emdee, Ltd。每年,他们都会和我和妻子一起在家里吃庆祝晚餐。

When our partnership distributed its Berkshire shares in 1969, all ofthe doctors kept the stock they received. They may not have known the ins andouts of investing or accounting, but they did know that at Berkshirethey would be treated as partners.

当我们的合伙人在1969年分配伯克希尔股票时,所有的医生都保留了他们得到的股票。他们可能不知道投资或会计知识,但他们知道,在伯克希尔他们将被视为合伙人。

Two of Stan’s comrades from Emdee are now in their high-90s and continueto hold Berkshire shares. This group’s startling durability – along with thefact that Charlie and I are 97 and 90, respectively – serves up an interestingquestion: Could it be that Berkshire ownership fosters longevity?

斯坦的两名来自Emdee的朋友现龄都90多岁了,他们仍然持有伯克希尔的股票。我们这群人有着惊人的持久性,再加上查理和我分别是97岁和90岁这个事实,这就提出了一个有趣的问题:长久持有伯克希尔股票会让人长寿吗?

***********

Berkshire’s unusual and valued family of individual shareholders may add toyour understanding of our reluctance to court Wall Street analysts andinstitutional investors. We already have the investors we want and don’tthink that they, on balance, would be upgraded by replacements.

伯克希尔的不同寻常、备受重视的个人股东群体,可能会让你更好地理解我们对于“讨好华尔街分析师及机构投资者”这一行为的不情愿。我们已经拥有了我们自己所理想中的投资者群体,并且总得来说,我们不认为他们会离开或是被替代。

There are only so many seats – that is, shares outstanding – availablefor Berkshire ownership. And we very much like the people already occupyingthem.

伯克希尔公司的“席位”——即流通股数——十分有限,我们对于那些已经拥有份额的投资者们致以真诚的敬意。

Of course, some turnover in “partners” will occur. Charlie and I hope,however, that it will be minimal. Who, after all, seeks rapid turnover infriends, neighbors or marriage?

当然,“合伙人”也会发生一些变动。不过,查理和我希望这不要有太大变动。毕竟,谁会希望自己的朋友、邻居或是婚姻是日异月更的呢?

In 1958, Phil Fisher wrote a superb book on investing. In it, he analogizedrunning a public company to managing a restaurant. If you are seeking diners,he said, you can attract a clientele and prosper featuring either hamburgersserved with a Coke or a French cuisine accompanied by exotic wines. Butyou must not, Fisher warned, capriciously switch from one to the other: Yourmessage to potential customers must be consistent with what they will find uponentering your premises.

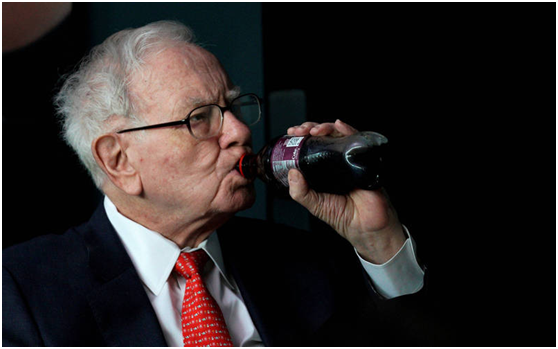

1958年,菲利普·费雪(Phil Fisher)写了一本投资领域的旷世奇作。在书中,他将经营一家上市公司比作经营一家餐厅。他说,你可以用汉堡配可口可乐或法国菜配上异国情调的葡萄酒来吸引顾客;但同时,他也提醒广大读者:不要随意地切换菜品的搭配方案,因为潜在客户所提供的信息必须要与他们进入餐厅后所发现的一致。

At Berkshire, we have been serving hamburgers and Coke for 56 years. Wecherish the clientele this fare has attracted.

在伯克希尔,我们已经提供“汉堡加可口可乐”长达56年,我们也十分珍视被我们的菜品搭配所吸引到的长期客户。

The tens of millions of other investors and speculators in the UnitedStates and elsewhere have a wide variety of equity choices to fit their tastes.They will find CEOs and market gurus with enticing ideas. If they want pricetargets, managed earnings and “stories,” they will not lack suitors.“Technicians” will confidently instruct them as to what some wiggles on a chartportend for a stock’s next move. The calls for action will never stop.

美国和其他地方的数千万投资者和投机者有各种各样的股票选择,以符合他们的偏好。他们将会找到拥有诱人想法的CEO和市场专家们。如果他们想要价格目标,管理收益和“美好的故事”,他们不会缺人的。“专家”将充满信心地指点他们,告诉他们股价图表上的某些波动会预示着股票未来的何种走势等等,对于交易行为的呼声永远不会停止。

Many of those investors, I should add, will do quite well. After all,ownership of stocks is very much a “positive-sum” game. Indeed, a patient andlevel-headed monkey, who constructs a portfolio by throwing 50 darts at a boardlisting all of the S&P 500, will – over time – enjoy dividends andcapital gains, just as long as it never gets tempted to make changes inits original “selections.”

我需要补充的是,这些投资者中的很多人会表现得很好。毕竟,持有股票很大程度上是一个“正和博弈”。实际上,就算是一只猴子,倘若可以头脑冷静且有足够耐心,通过向标普500的上市公司投掷50个飞镖来构建投资组合,随着时间的推移,其也可以享受到丰厚的股息和资本利得——前提是他们不会轻易因为受到诱惑而改变之前的“选择”。

Productive assets such as farms, real estate and, yes, businessownership produce wealth – lots of it. Most owners of such propertieswill be rewarded. All that’s required is the passage of time, an inner calm,ample diversification and a minimization of transactions and fees. Still,investors must never forget that their expenses are Wall Street’s income.And, unlike my monkey, Wall Streeters do not work for peanuts.

诸如农场、房地产、企业所有权这样的生产性资产,都可以产生财富——大量的财富。大多数拥有这些财产的人都将得到回报,所需要的仅仅是时间的流逝、内心的平静、充分的多元化配置以及交易费用的最小化。不过,投资者们绝不能忘记一点,即他们的支出便是华尔街的收入。不过,和猴子不同,华尔街的人可绝对不是为了花生工作,你懂我的意思。

When seats open up at Berkshire – and we hope they are few – we wantthem to be occupied by newcomers who understand and desire what we offer. Afterdecades of management, Charlie and I remain unable to promise results. We canand do, however, pledge to treat you as partners.

当伯克希尔有空位的时候——当然我们希望这不会太多——我们希望这些空位可以被那些充分了解我们并渴望得到我们所提供服务的投资者所拥有。即便在资产管理领域摸爬滚打几十年,查理与我仍无法拍着胸脯保证投资的结果。但是,我们能够并确实会保证会将投资者们视为亲密无间的合作伙伴。

And so, too, will our successors.

我们的继任者也将如此。

A Berkshire Number that May Surprise You

伯克希尔的一个可能令你吃惊的数字

Recently, I learned a fact about our company that I had never suspected:Berkshire owns American-based property, plant and equipment – the sortof assets that make up the “business infrastructure” of our country – with aGAAP valuation exceeding the amount owned by any other U.S. company.Berkshire’s depreciated cost of these domestic “fixed assets” is $154billion. Next in line on this list is AT&T, with property, plant andequipment of $127 billion.

最近,我了解到一个事实,并深信不疑:伯克希尔拥有美国的房地产、工厂和设备——这类资产构成了我们国家的“商业基础设施”——在GAAP下的估值超过了其他任何一家美国公司。伯克希尔对这些国内“固定资产”的折旧成本为1540亿美元。紧随其后的是美国电话电报公司(AT&T),拥有资产、厂房和设备,价值1270亿美元。

Our leadership in fixed-asset ownership, I should add, does not,in itself, signal an investment triumph. The best results occur atcompanies that require minimal assets to conduct high-margin businesses– and offer goods or services that will expand their sales volume withonly minor needs for additional capital. We, in fact, own a few of theseexceptional businesses, but they are relatively small and, at best, growslowly.

我应该补充一点,我们在固定资产所有权方面的领导地位,本身并不意味着投资取得了胜利。最好的投资结果出现在那些只需要很少资产就能开展高利润业务的公司,以及那些只需要很少额外资本就能扩大销售额的产品或服务的公司。事实上,我们拥有一些这样的杰出企业,但它们相对较小,发展也比较缓慢。

Asset-heavy companies, however, can be good investments. Indeed,we are delighted with our two giants – BNSF and BHE: In 2011, Berkshire’s firstfull year of BNSF ownership, the two companies had combined earnings of $4.2billion. In 2020, a tough year for many businesses, the pair earned $8.3billion.

然而,重资产的公司依然可能会是很好的投资选择。我们很高兴看到我们的两大巨头——BNSF 和BHE :2011年,伯克希尔持有BNSF的第一年,这两家公司的总收益为42亿美元。到了2020年,对许多企业来说都是艰难的一年,而这两家公司去年的收入达到83亿美元。

BNSF and BHE will require major capital expenditures for decades tocome. The good news is that both are likely to deliver appropriate returns onthe incremental investment.

BNSF和BHE在未来几十年将需要大量的资本支出。但好消息是,这两家公司都将会带来适当的增量投资回报。

Let’s look first at BNSF. Your railroad carries about 15% of allnon-local ton-miles (a ton of freight moved one mile) of goods that move in theUnited States, whether by rail, truck, pipeline, barge or aircraft. By asignificant margin, BNSF’s loads top those of any other carrier.

我们先来看BNSF。该公司铁路运输的非本地货物的吨英里数占全美国(囊括了铁路、卡车、管道、驳船和飞机各个运输方式)的15%。BNSF的装载量远远超过其他任何一家运输公司。

The history of American railroads is fascinating. After 150 years or soof frenzied construction, skullduggery, overbuilding, bankruptcies,reorganizations and mergers, the railroad industry finally emerged a fewdecades ago as mature and rationalized.

美国铁路的历史很有趣。在经历了150年左右的疯狂建设、欺诈、过度建设、破产、重组和合并之后,铁路行业终于在几十年前趋于成熟并合理化了。

BNSF began operations in 1850 with a 12-mile line in northeasternIllinois. Today, it has 390 antecedents whose railroads have been purchased ormerged. The company’s extensive lineage is laid out at http://www.bnsf.com/bnsf-resources/pdf/about-bnsf/History_and_Legacy.pdf.

1850年运营之初,BNSF仅在伊利诺伊州东北部有一条12英里长的铁路线。如今,它通过一系列收购和合并而形成了390条铁路线。这家公司广泛的分布可以参看http://www.bnsf.com/bnsf-resources/pdf/about-bnsf/History_and_Legacy.pdf.

Berkshire acquired BNSF early in 2010. Since our purchase, the railroadhas invested $41 billion in fixed assets, an outlay $20 billion in excess ofits depreciation charges. Railroading is an outdoor sport, featuring mile-longtrains obliged to reliably operate in both extreme cold and heat, as they allthe while encounter every form of terrain from deserts to mountains. Massiveflooding periodically occurs. BNSF owns 23,000 miles of track, spreadthroughout 28 states, and must spend whatever it takes to maximize safety andservice throughout its vast system.

2010年初伯克希尔收购了BNSF,由此BNSF(有了足够的资金)来铺开铁路线网络。自从被我们收购以来,BNSF的铁路业务已经在固定资产上投资了410亿美元,除开折旧费用,投资额达200亿美元。铁路运输是露天的,不管是极寒天气还是极热天气,不管是沙漠还是山区,不管有没有遇到大规模洪水,火车都必须可靠地运行。BNSF拥有23000英里的铁路,遍布28个州,在这么庞大的铁路系统中,我们必须不惜一切代价在其庞大的系统中最大化安全和服务。

Nevertheless, BNSF has paid substantial dividends to Berkshire – $41.8billion in total. The railroad pays us, however, only what remains after itboth fulfills the needs of its business and maintains a cash balance of about$2 billion. This conservative policy allows BNSF to borrow at low rates,independent of any guarantee of its debt by Berkshire.

尽管如此,BNSF还是向伯克希尔支付了巨额股息,总计418亿美元。然而,铁路公司只会在满足其业务需要并保留大约20亿美元的现金后才会支付给我们剩下的钱。这种保守的政策允许BNSF以低利率借款,而不依赖伯克希尔对其债务的任何担保。

One further word about BNSF: Last year, Carl Ice, its CEO, and hisnumber two, Katie Farmer, did an extraordinary job in controlling expenseswhile navigating a significant downturn in business. Despite a 7% decline inthe volume of goods carried, the two actually increased BNSF’s profit margin by2.9 percentage points. Carl, as long planned, retired at yearend and Katie tookover as CEO. Your railroad is in good hands.

关于BNSF还有一点值得注意:去年,该公司首席执行官CarlIce和他的二把手Katie Farmer在控制开支方面表现出色,同时度过了业务的严重低迷期。尽管载货量下降了7%,但这他们实际上使BNSF的利润率提高了2.9个百分点。Carl如计划的那样,在年底退休了,Katie接任了首席执行官一职,铁路的管理状况依旧令人安心。

BHE, unlike BNSF, pays no dividends on its common stock, ahighly-unusual practice in the electric-utility industry. That Spartan policyhas been the case throughout our 21 years of ownership. Unlike railroads, ourcountry’s electric utilities need a massive makeover in which the ultimatecosts will be staggering. The effort will absorb all of BHE’s earnings fordecades to come. We welcome the challenge and believe the added investment willbe appropriately rewarded.

与BNSF不同的是,BHE对其普通股不派息,这在电力行业是极不寻常的做法。这种“斯巴达”式的政策贯穿了我们的21年持有期。与铁路行业不同,美国国家的电力设施需要大规模的改造与翻新,最终的成本将是天文数字。这一成本支出将“透支”在未来几十年BHE的全部收入。但我们乐意接受挑战,相信所增加的投资将得到适当的回报。

Let me tell you about one of BHE’s endeavors – its $18 billioncommitment to rework and expand a substantial portion of the outdated grid thatnow transmits electricity throughout the West. BHE began this project in 2006and expects it to be completed by 2030 – yes, 2030.

让我来告诉你BHE的一项努力——它承诺投入180亿美元,对已经过时的电网进行返工和扩建,这些电网现在正在向整个西部地区输送电力。BHE在2006年开始这个项目,预计在2030年完成——是的,2030年。

The advent of renewable energy made our project a societal necessity.Historically, the coal-based generation of electricity that long prevailed waslocated close to huge centers of population. The best sites for the new worldof wind and solar generation, however, are often in remote areas. When BHEassessed the situation in 2006, it was no secret that a huge investment inwestern transmission lines had to be made. Very few companies or governmentalentities, however, were in a financial position to raise their hand after theytallied the project’s cost.

可再生能源的出现使我们所投资的项目成为社会的必需品。从历史上看,长期以来盛行的燃煤发电都位于人口密集的地区,然而,新世界风能和太阳能发电的最佳地点往往是在偏远地区。当BHE在2006年评估形势时,对西部输电线路进行巨额投资已不是什么秘密。然而,很少有公司或政府机构在计算完项目成本后能有足够的财力开展建设项目。

BHE’s decision to proceed, it should be noted, was based upon its trustin America’s political, economic and judicial systems. Billions of dollarsneeded to be invested before meaningful revenue would flow. Transmission lineshad to cross the borders of states and other jurisdictions, each with its ownrules and constituencies. BHE would also need to deal with hundreds oflandowners and execute complicated contracts with both the suppliers thatgenerated renewable power and the far-away utilities that would distribute theelectricity to their customers. Competing interests and defenders of the oldorder, along with unrealistic visionaries desiring an instantly-new world, hadto be brought on board.

值得一提的是,BHE的决定是基于它对美国政治、经济和司法体系的信任。要获得可观的收入,需要先投入数十亿美元。输电线路必须跨越各州和其他司法管辖区的边界,每个州都有自己的规则和选区。BHE还需要与数百名土地所有者打交道,并与生产可再生能源的供应商和向客户输送电力的远方公用事业公司签订复杂的合同。相互竞争的利益相关方、旧秩序的捍卫者,以及那些渴望建立“新世界”的梦想家们,都会加入进来。

Both surprises and delays were certain. Equally certain, however, wasthe fact that BHE had the managerial talent, the institutional commitment andthe financial wherewithal to fulfill its promises. Though it will be many yearsbefore our western transmission project is completed, we are today searchingfor other projects of similar size to take on.

惊喜和延迟都是肯定的。然而,同样可以肯定的是,BHE有管理才能、机构承诺和财力来履行其承诺。虽然我们的西部输电项目要多年才能完成,但我们目前也正在积极寻找其他类似规模的项目来承担。

Whatever the obstacles, BHE will be a leader in delivering ever-cleanerenergy.

无论遇到何种障碍,BHE都将成为提供更清洁能源的领导者。

The Annual Meeting

股东大会

Last year, on February 22nd, I wrote you about our plans for a gala annualmeeting. Within a month, the schedule was junked.

去年2月22日,我写信告诉你我们计划召开一个盛大的股东大会。不到一个月,这个计划就被取消了。

Our home office group, led by Melissa Shapiro and Marc Hamburg,Berkshire’s CFO, quickly regrouped. Miraculously, their improvisations worked.Greg Abel, one of Berkshire’s Vice Chairmen, joined me on stage facing a darkarena, 18,000 empty seats and a camera. There was no rehearsal: Greg and Iarrived about 45 minutes before “showtime.”

由Melissa Shapiro和伯克希尔首席财务官Marc Hamburg领导的总部小组迅速重组,他们的即兴方案奇迹般地奏效了。我也和伯克希尔副董事长之一Greg Abel一起走上台,面对着一个漆黑的舞台、1.8万个空座位和一台摄像机。我们在“表演时间”开始前45分钟就位,没有彩排。

Debbie Bosanek, my incredible assistant who joined Berkshire 47 yearsago at age 17, had put together about 25 slides displaying various facts andfigures that I had assembled at home. An anonymous but highly-capable team ofcomputer and camera operators projected the slides onto the screen in properorder.

Debbie Bosanek是我的绝佳助手,她是47年前加入伯克希尔哈撒韦的,当时她只有17岁。她整理了约25张幻灯片,用以展示我在家里收集好的各种事实和数据,还有一个能力很强的幕后计算机和摄制团队,将幻灯片按顺序一一投射到屏幕上。

Yahoo streamed the proceedings to a record-sized international audience.Becky Quick of CNBC, operating from her home in New Jersey, selected questionsfrom thousands that shareholders had earlier submitted or that viewers hademailed to her during the four hours Greg and I were on stage. See’s peanutbrittle and fudge, along with Coca-Cola, provided us with nourishment.

雅虎直播了股东大会的整个过程,观众达到创纪录的规模。CNBC的Becky Quick,待在她位于新泽西州的家中,从数千个股东早前提交的问题、以及观众在我和Greg上台的四个小时里通过电子邮件发给她的问题当中,挑选出问题向我们转述。当时我们吃着See的花生糖和软糖,喝着可口可乐。

This year, on May 1st, we are planning to go one better. Again, we will rely onYahoo and CNBC to perform flawlessly. Yahoo will go live at 1 p.m. EasternDaylight Time (“EDT”). Simply navigate to https://finance.yahoo.com/brklivestream.

今年5月1日,我们计划办一场更好的股东大会。我们仍然将依赖于雅虎和CNBC的完美表现。雅虎通道将于美国东部夏令时间下午1点上线,直播网址https://finance.yahoo.com/brklivestream。

Our formal meeting will commence at 5:00 p.m. EDT and should finish by5:30 p.m. Earlier, between 1:30-5:00, we will answer your questions as relayedby Becky. As always, we will have no foreknowledge as to what questions will beasked. Send your zingers to BerkshireQuestions@cnbc.com. Yahoo will wrap thingsup after 5:30.

正式会议将于美东时间下午5点开始,下午5点半结束。早些时候,在1:30-5:00之间,我们会回答由Becky转达的问题。一如既往,我们无法预知会被问到哪些问题。届时请将问题发送到BerkshireQuestions@cnbc.com,雅虎将在5:30后关闭通道。

And now – drum roll, please – a surprise. This year our meeting will beheld in Los Angeles . . . and Charlie will be on stage with me offeringanswers and observations throughout the 31⁄2-hour question period. I missed himlast year and, more important, you clearly missed him. Our otherinvaluable vice-chairmen, Ajit Jain and Greg Abel, will be with us to answerquestions relating to their domains.

现在(此处应有掌声)惊喜来了!今年我们的会议将在洛杉矶举行……查理将会和我一起在台上参与整整三个半小时的提问环节,回答问题并发表观点。去年我很想念他,更重要的是,你们显然也很想念他。其他两位副董事长,Ajit Jain和Greg Abel,将与我们一起回答有关他们业务领域的问题。

Join us via Yahoo. Direct your really tough questions to Charlie! Wewill have fun, and we hope you will as well.

通过雅虎加入我们,直接把你的难题掷问查理吧!我们会玩得很开心,希望你们也一样。

Better yet, of course, will be the day when we see you face to face. Ihope and expect that will be in 2022. The citizens of Omaha, our exhibitingsubsidiaries and all of us at the home office can’t wait to get you back for anhonest-to-God annual meeting, Berkshire-style.

当然,更好的还是我们有一天能面对面见到你们,我希望那会是2022年。奥马哈市的市民、我们参展的子公司以及我们总部的所有人都迫不及待地想让你们回来,参加一场伯克希尔式的、真正的年度股东大会。

February 27, 2021

2021年2月27日

Warren E. Buffett Chairman of the Board

沃伦·巴菲特董事会主席

(作者:阿浦美股 )

声明:本文由21财经客户端“南财号”平台入驻机构(自媒体)发布,不代表21财经客户端的观点和立场。