中英文带你速览中国经济头条。

Hi everyone. I’m Stephanie LI.

大家好,我是主持人李莹亮。

Coming up on today’s program.

重点提要

China’s economy in July posted steady recovery;

PBOC cuts interest rates by 10bps.

Here’s what you need to know about China in the past 24 hours

中国经济要闻

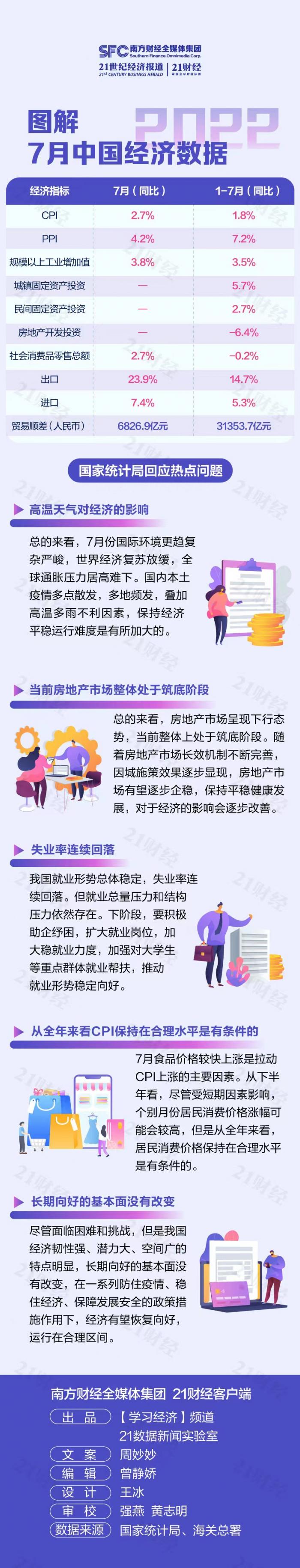

China released its main economic indicators for July on Monday, maintaining growth momentum from June as the world's second-largest economy is on track for a strong economic recovery amid government stimulus, but a lower-than-expected expansion pace signals headwinds linked to global uncertainty and sporadic COVID-19 flare-ups.

Retail sales grew by 2.7 percent in July from a year ago, down from growth of 3.1 percent in June, the National Bureau of Statistics (NBS) said on Monday.

Industrial profits rose by 3.8 percent in July, a decline from the 3.9-percent increase in June and missed market expectations of 4.6-percent growth. Profits at Chinese industrial firms returned to growth in June after two months in the red.

Fixed asset investment for the first seven months of the year increased by 5.7 percent from a year ago, a drop from the 6.1 percent in the January to June period. Investment in property development went down 6.4 percent, standing at 7.95 trillion yuan. The property development climate index compiled by the NBS came in at 95.26 points in July.

The unemployment rate came in at 5.4 percent in July, a decline of 0.1 percent from June.

"The national economy maintained strong recovery momentum," NBS spokesperson Fu Linghui said Monday, yet warning of rising stagflation risks globally and said "the foundation for the recovery of the domestic economy has yet to be consolidated.”

Despite these difficulties and challenges, the fundamentals for long-term growth have not changed, Fu said, noting that China's economy, with strong resilience, and great potential will gradually recover and is expected to run in a reasonable range backed by a series of anti-epidemic and pro-growth economic policies and measures.

The Chinese government unveiled a series of stimulus to prompt up growth. In a fresh move, China's central bank on Monday unexpectedly lowered interest rates on key lending facilities for the second time this year.

The People's Bank of China (PBOC) said it was lowering the rate on 400 billion yuan of one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points to 2.75 percent, versus 2.85 percent. The central bank said it also lowered the interest rate of seven-day reverse repos from 2.1 percent to 2 percent in its 2 billion yuan worth of reverse repo operations on Monday, fully satisfying financial institutions' needs.

7月份我国经济运行成绩表出炉。

国新办8月15日举行新闻发布会,国家统计局相关负责人介绍当前经济形势。7月份,我国高效统筹疫情防控和经济社会发展,有力实施稳经济一揽子政策措施,生产供给继续恢复,就业物价总体平稳,经济延续恢复态势。

从工业看,工业生产稳定增长。7月份,全国规模以上工业增加值同比增长3.8%。其中,装备制造业、高技术制造业增加值同比增长8.4%、5.9%,分别快于规模以上工业增加值4.6、2.1个百分点。

从服务业看,全国服务业生产指数同比增长0.6%,服务业继续恢复。

从消费看,7月份,社会消费品零售总额35870亿元,同比增长2.7%;市场销售持续恢复,升级类商品销售保持活跃态势。

从投资看,1—7月份,全国固定资产投资319812亿元,同比增长5.7%。其中,高技术产业投资、社会领域投资都保持了两位数的较快增长。

从就业看,7月份就业形势总体稳定,全国城镇调查失业率为5.4%,比上月下降0.1个百分点。1—7月份,全国城镇新增就业783万人。

国家统计局新闻发言人、国民经济综合统计司司长付凌晖表示,综合来看,7月份我国经济延续恢复态势,运行基本平稳。但是也要看到,受多重因素的影响,经济恢复的势头边际放缓,巩固经济回升的基础仍需加力。下阶段,要继续高效统筹疫情防控和经济社会发展,着力扩大国内需求,着力保障产业链供应链稳定,着力深化改革开放,坚决守住安全发展底线,扎实做好民生保障,推动经济持续健康发展。

经济下行压力加大,货币政策也需发力稳增长,激发实体经济的信贷需求。7月数据公布的同时,人民银行公告称,为维护银行体系流动性合理充裕,8月15日开展4000亿元中期借贷便利(MLF)操作(含对8月16日MLF到期的续做)和20亿元公开市场逆回购操作,充分满足了金融机构需求。中期借贷便利(MLF)操作和公开市场逆回购操作的中标利率分别为2.75%、2.0%,均下降10个基点。

1年期MLF利率和7天逆回购利率是最为重要的政策利率,其调整具有风向标意义,对债券市场、信贷市场、汇率市场甚至股市价格均会产生影响。

China's national observatory on Monday renewed a red alert for high temperatures, the highest warning in its four-tier system, as sweltering heatwaves hit many regions of the country. Temperatures in parts of Sichuan, Chongqing, Shaanxi, Henan, Anhui, Jiangsu, Hubei, Hunan, Jiangxi, Zhejiang and Xinjiang may surpass 40 degrees Celsius, the meteorological centre said. Fifty-five observatories in Central, Western and Eastern China reported to have reached or exceeded record heat on Friday.

高温红色预警继续:中央气象台8月15日06时继续发布高温红色预警,其中,四川东部、重庆中西部、陕西南部、河南东南部、安徽中南部、江苏南部、湖北东南部和西北部、湖南北部、江西东北部、浙江中北部以及新疆吐鲁番盆地等地的部分地区最高气温可达40℃以上。13日,四川、湖北、陕西、江苏、安徽、浙江、重庆等地共55个国家站气温达到或突破历史极值。

Moving on to regional highlights

区域观察

The Sixth Silk Road International Exposition opened Sunday in Xi'an with deeper Belt and Road cooperation high on the agenda. The five-day expo has attracted participants from over 70 countries and regions, featuring meetings and forums that cover topics such as RCEP regional economic and trade cooperation, smart manufacturing and green development.

第六届丝博会开幕:8月14日,第六届丝绸之路国际博览会暨中国东西部合作与投资贸易洽谈会在西安开幕。本届丝博会由乌兹别克斯坦共和国担任主宾国,以“共享共赢”为主题,共邀请到全球70多个国家和地区,以及国际组织在华嘉宾及客商1000多人参加展会。

Next on industry and company news

产业及公司新闻

China's home prices in 70 large and medium-sized cities displayed a generally stable trend in July. New home prices in four first-tier cities, Beijing, Shanghai, Shenzhen and Guangzhou, edged up 0.3 percent month on month in July, according to NBS data. New home prices in 31 second-tier cities stayed flat month on month, while 35 third-tier cities saw a month-on-month decline of 0.3 percent, the same level as that in June. Last month, 40 out of the 70 cities saw a month-on-month drop in new home sales prices.

70城房价出炉:国家统计局15日发布2022年7月份70个大中城市商品住宅销售价格变动情况。2022年7月份,70个大中城市中商品住宅销售价格下降城市个数略增。一线城市商品住宅销售价格环比微涨、同比涨幅回落,二三线城市环比整体呈降势、同比降幅扩大。

China's nationwide box office in the summer film season from June 1 to August 31 has exceeded 7.6 billion yuan as of 18 p.m. on Sunday, surpassing the 7.4 billion yuan mark in the same period last year, showing a positive recovery sign of the film industry previously battered by COVID-19.

暑期档票房突破76亿元:截至8月14日18时,今年暑期档(6月1日-8月31日)电影票房突破76亿元,已经超过去年暑期档总票房,电影市场保持良好恢复势头。

China Tourism Group Duty Free Corp will offer 102.76 million shares globally in its Hong Kong listing from Monday, with about 5.14 million shares offered in Hong Kong and 97.62 million internationally, according to an announcement by the company. The offer price will set between HK$143.50-165.50 per share. Dealings in the H Shares is expected to commence on Aug 25.

中国中免今起招股:中国中免8月15日起招股,全球发售接近1.03亿股,每股定价介于143.5至165.5港元,集资额介于149.5亿至170.1亿港元。中国中免将在8月18日截止招股,预计将在8月25日挂牌。

Earnings reports express

财报速递

Chinese tech giant Huawei's revenue reached 301.6 billion yuan ($44.7 billion) in the first half of 2022, with a net profit margin of 5 percent, according to the company's semiannual report released on Friday. As for the company's three main businesses, the carrier business revenue reached 142.7 billion yuan, the revenue from enterprise business amounted to 54.7 billion yuan, and device business revenue hit 101.3 billion yuan.

华为上半年实现营收3016亿元:8月12日,华为发布上半年经营业绩报告显示,期内华为实现销售收入3016亿元(去年同期为3204亿元),净利润率达5%,较去年同期下降了4.8个百分点;按业务板块划分,上半年华为运营商业务、企业业务及终端业务分别实现收入1427亿元、547亿元、1013亿元。

Chinese video surveillance firm Hikvision Digital Technology reported net profit of 5.8 billion yuan, down 11.1 percent in the first half of 2022 from the same period last year. Operating income was 37.3 billion yuan, up 9.9 percent in the period. Domestic revenue rose 1.6 percent to 20.1 billion yuan, while revenue from the main overseas business soared 18.9 percent to 9.7 billion yuan. Hikvision’s net outflow of operating cash was 2.2 billion yuan in the first six months of the year, versus a net inflow of nearly 2 billion yuan a year earlier, mainly due to a rising inventories and procurement spendings.

海康威视上半年增收不增利:8月12日晚间,海康威视发布2022年半年报。今年上半年实现营业总收入372.58亿元,比上年同期增长9.90%,更多的增长来自境外主业;实现归母净利润57.59亿元,比上年同期下降11.14%。上半年,经营活动产生的现金流量净额为净流出21.58亿元,而2021年上半年则为净流入19.63亿元,大幅下降209.97%。海康威视表示,上游原材料成本快速上涨,采购备货大幅增加,是造成存货上升和经营现金流数据不理想的主要原因。

Switching gears to financial news

金融市场消息

Five Chinese state-owned giants including PetroChina Co Ltd, China Life Insurance Co, China Petroleum & Chemical Corp, Aluminum Corp of China and Sinopec Shanghai Petrochemical Co. on Friday separately announced plans to delist their American depository share from the New York Stock Exchange. Shortly after the announcements, China's top stock regulator issued a statement, stressing that the companies' decisions were made out of their own commercial considerations and that it will maintain communication with relevant overseas regulatory agencies to jointly protect the legitimate rights and interests of companies and investors.

5家央企主动自美退市: 8月12日,中国石油、中国石化、中国铝业、中国人寿、上海石化等5家国有控股企业发布公告,宣布计划将美国存托股从纽约证券交易所退市。同日,中国证监会官方网站发布消息,以有关部门负责人答记者问的形式对此作出回应称,上市和退市都属于资本市场常态。根据相关企业公告信息,这些企业在美国上市以来严格遵守美国资本市场规则和监管要求,作出退市选择是出于自身商业考虑。

By the end of July, a total of 3.47 trillion yuan of new special-purpose bonds had been issued in China, with localities having almost completed full issuance, half a year earlier than last year, data from China's Ministry of Finance showed on Sunday. As of the end of July, special bond funds had supported the construction of more than 26,100 projects.

前7月新增专项债3.47万亿元:财政部14日发布数据,截至7月末,各地已累计发行新增专项债券3.47万亿元,发行使用进度明显加快;专项债资金共支持超过2.61万个项目建设,其中在建项目约1.44万个,新建项目约1.17万个。

The China Securities Regulatory Commission (CSRC) and Securities and Futures Commission of Hong Kong (SFC) announced in-principal approval to enhance the trading calendar of Stock Connect on Friday, which the current number of untradeable days is expected to fall by about half.

证监会优化沪深港通交易日历:中国证监会、香港证券及期货事务监察委员会12日发布《联合公告》,宣布优化沪深港通交易日历安排。港交所表示,在优化安排实施后,香港联合交易所有限公司、上海证券交易所和深圳证券交易所将在两地市场均开市的所有交易日同时开放沪深港通交易服务。据测算,交易日历优化后,预计可将目前无法交易的天数减少约一半。

Wrapping up with a quick look at the stock market

股市收盘情况

Chinese stocks closed mixed on Monday after factory and retail activity slowed in July while the central bank unexpectedly cut key rates to support the economy. By the close, the benchmark Shanghai Composite closed almost flat while the Shenzhen Component closed 0.33 percent higher. The Hang Seng Index edged down 0.67 percent and the TECH Index dropped 0.96 percent.

周一A股三大指数走势分化。截至今日收盘,沪指跌0.02%,深成指涨0.33%;创业板指涨1.03%。板块方面,光伏、锂矿、储能、风电等表现活跃;旅游、银行、保险等板块均走弱。港股恒生指数跌0.67%,恒生科技股指数跌0.96%。

Biz Word of the Day

财经词汇划重点

Medium-term Lending Facility (MLF) refers to the central bank's monetary policy tool for providing medium-term base currency. The medium-term lending facility interest rate adjusts the cost of medium-term financing of financial institutions and guides them to provide low-cost funds to the real economy sectors, leading to the reduction of social financing costs. After China completed interest rates reforms in 2015, MLF has become the PBOC's key policy interest rate.

中期借贷便利,是指中央银行提供中期基础货币的货币政策工具。中期借贷便利利率发挥中期政策利率的作用,通过调节向金融机构中期融资的成本,引导其向符合国家政策导向的实体经济部门提供低成本资金,促进降低社会融资成本。中国利率市场化改革后,利率调整不再是存贷款基准利率,而是央行政策利率。

Executive Editor: Sonia YU

Editor: LI Yanxia

Host: Stephanie LI

Writer: Stephanie LI, ZENG Libin

Sound Editor: ZENG Libin

Graphic Designer: ZHENG Wenjing, LIAO Yuanni

Produced by 21st Century Business Herald Dept. of Overseas News.

Presented by SFC

编委: 于晓娜

策划、编辑:李艳霞

播音:李莹亮

撰稿:李莹亮、曾丽镔

音频制作:曾丽镔

设计:郑文静、廖苑妮

21世纪经济报道海外部 制作

南方财经全媒体集团 出品

(作者:李莹亮 编辑:李艳霞)

21世纪经济报道及其客户端所刊载内容的知识产权均属广东二十一世纪环球经济报社所有。未经书面授权,任何人不得以任何方式使用。详情或获取授权信息请点击此处。