By Shi Shi, Yang Yulai, SFC, 21st Century Business Herald

Editor’s Note:

As the world moves toward 2026, multiple economic cycles and structural shifts are converging. Global growth remains uneven, inflation and monetary policy paths are uncertain, and geopolitical tensions and industrial realignments continue to reshape the international order. At the same time, China enters the starting phase of 15th Five-Year Plan, with implications that extend well beyond its borders.

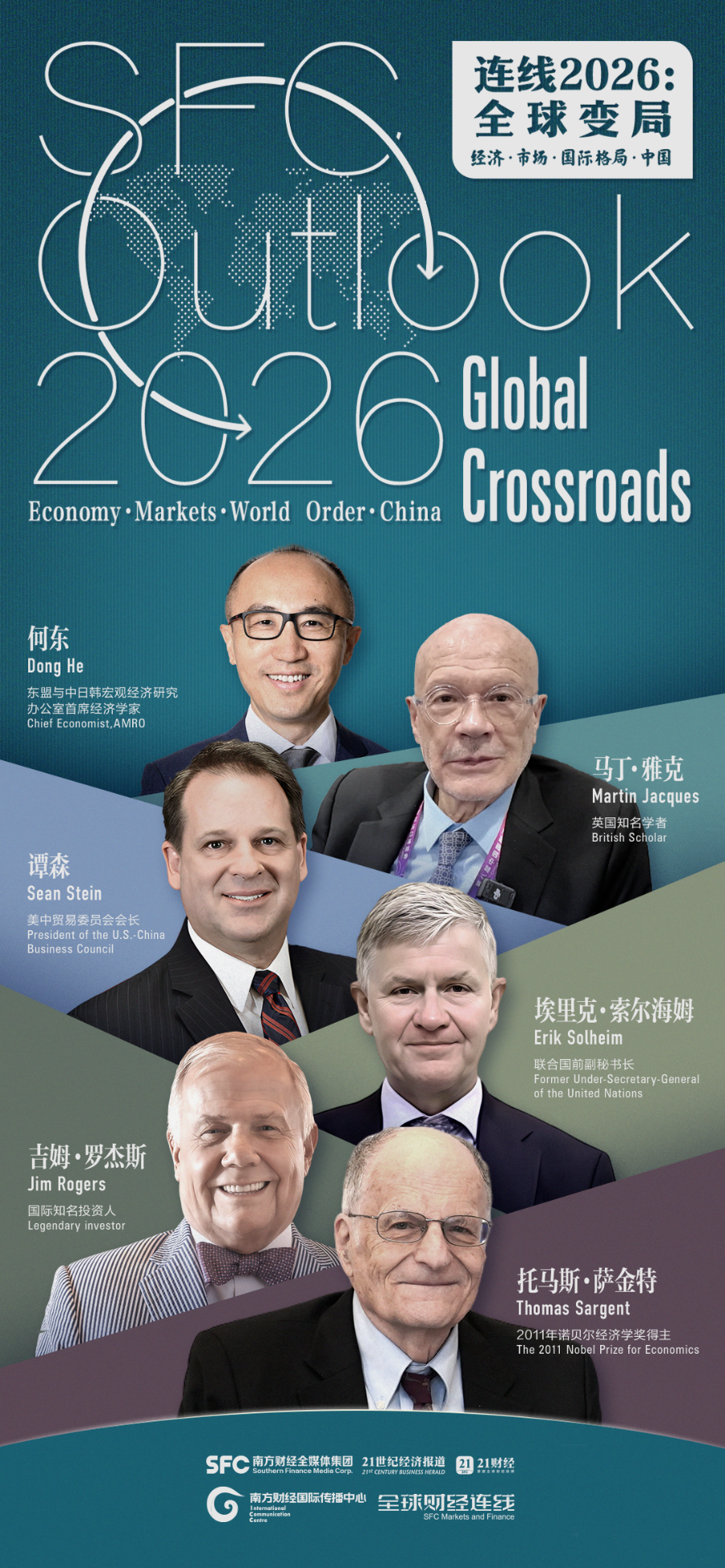

SFC Outlook 2026: Global Crossroads brings together distinguished economists, scholars, investors and political figures to assess the global economy, financial markets, the evolving world order, and China’s development at this critical juncture. Through in-depth conversations and forward-looking perspectives, the series offers a comprehensive outlook on the forces shaping the years ahead.

Supported by technological innovation and accommodative monetary policies, global asset prices staged a broad rally in 2025. Major U.S. stock indices repeatedly hit record highs, while the UK’s FTSE 100, Japan’s Nikkei 225 and China’s key benchmarks all reached multi-year peaks. Prices of bulk commodities such as gold and silver also rose rapidly, with risk concerns fading amid widespread optimism.

As nearly all asset classes moved higher, questions emerged over whether risks were being underestimated. Legendary investor Jim Rogers has remained highly alert. In an interview with Southern Finance Media Group, he warned that prolonged loose policies and expanding debt have inflated asset prices and quietly increased the potential impact of future market corrections. “When everything is going up, that’s when you should start to worry,” he said.

Despite his concerns over a global asset bubble, Rogers continues to hold Chinese equities as part of his long-term, intergenerational strategy. He believes China’s large and well-educated population, relatively low debt levels and opening markets will sustain its competitiveness, adding that China remains one of the most promising countries of the 21st century.

Rogers also expressed confidence in Guangdong Province, saying that despite challenges and structural adjustments, it will continue to serve as a key global economic hub.

Looking ahead to 2026, he urged investors to stay cautious while remaining hopeful.

Global markets need to guard against a bubble burst

SFC Markets and Finance: Would you like to go over the global market in 2025?

Jim Rogers: All over the world markets have done well in 2025, partly because there's been a lot of money printing everywhere—Japan, the US, everywhere—so markets nearly everywhere, including China, have done and are doing very well; I still own Chinese shares, but I don't know what to do because they have been going straight up.

My plan is that my children will own my Chinese shares some day because China is going to be a great country in their lifetime, but I don't know for sure now that everything is going up. In my experience, when everything is going up, it's a time to ask questions and start worrying, so I'm starting to worry, but I have not sold my Chinese shares yet.

SFC Markets and Finance: SFC Markets and Finance: Are we in a global market re-rating? What's driving it?

Jim Rogers: Lots of easy money is available everywhere in the world, certainly in the US, which is the largest economy, and there’s also lots of money printing in Japan—the Japanese market is going straight up because there’s so much money around everywhere, and that’s the main driver of market performance all over the world. There’s lots and lots of easy money, and everybody's happy; but when everybody is happy, I start to worry, and I am worried now.

SFC Markets and Finance: Why there are so many easy money?

Jim Rogers: Everybody likes easy money, nobody wants a bad time or hard times—everyone wants free money and easy money—and many governments and politicians know this, so they keep printing, printing, printing, and that’s exactly what’s been happening; as a result, there’s a lot of easy money in nearly every country in the world, especially in Japan and America. Is it good? We don’t know. We’ll find out.

SFC Markets and Finance: Do you think the U.S. asset price is too high at this moment?

Jim Rogers: Yes, I have sold my U.S. stocks. They may go higher. When a bubble develops, crazy things happen. And there's a lot of easy money in the US, so stocks have been going up. A bubble will probably develop. It will get crazy. And you should worry a lot. I will worry a lot.

SFC Markets and Finance: What do you worry about?

Jim Rogers: Bubbles. Bubbles are great if you know what you're doing. Everybody's happy in a bubble, but bubbles always pop. Bubbles always come to an end. And it's usually painful for many, many people. And that's what worries me. And when this bubble develops and pops, it will be bad for many people. I hope I survive.

Optimistic about China's tourism and related sectors

SFC Markets and Finance: What do you think about China's stock market?

Jim Rogers: I own Chinese shares. I have owned them for many years. It's been going straight up recently. I have not sold anything in China. My hope is that I never have to sell. That someday my children will have my Chinese shares, but it's been going straight up recently, as you know. And that usually is something to worry about, so I'm asking questions. I have not sold anything in China yet, but I'm asking questions. I'm starting to worry.

SFC Markets and Finance: What keeps you long-term bullish on China?

Jim Rogers: China is the only country in world history that's been on top 3 or 4 times. That's been on top 3 or 4 times. Rome was great once. Britain was great once. Egypt was great once, but China's been great three or four times, nobody else has done it. When China collapses, they stay on the bottom for a while and they rise to the top again. I don't know why. If you know why, don't tell anybody. I want to know because nobody else has done it.

SFC Markets and Finance: Which Chinese stocks are you holding right now?

Jim Rogers: I own 20 or 30 airlines. Anything to do with travel entertainment. Now China is opening up. People can travel to other countries and many people want to travel to China. So I think the travel and tourism in China continues to have a very good future.

SFC Markets and Finance: So you prefer tourism?

Jim Rogers: Travel. I mean hotels, airlines, anything to do with opening up of China to the outside world and for people to come to China has a very exciting future.

SFC Markets and Finance: What's your predictions of global market in 2026?

Jim Rogers: I'm worried. I repeat the US, which is the biggest has been going up since 2008, 2009, everybody is doing well. And in the past, when everybody does well for a long time, it usually leads to problems later on. So I am very worried about the world markets in 2026. Very worried.

SFC Markets and Finance: I think most investors are very worried too. Do you have any advices for them?

Jim Rogers: Well, my advice, people think investing is easy. It's not, it's very difficult, but everybody thinks I could do that. My advice is for people to stay with what you know. Everybody knows a lot about something, whatever it is, that's where you start and that's where you stay. And if you stay with what you know, you will be a successful investor. Don't listen to me, don't listen to you, don't listen to anybody, stay with what you know and you will be an investor, a successful investor.

SFC Markets and Finance: Once you mentioned, China will be the most successful country of the 21st century, do you still believe it?

Jim Rogers: Of course. I mean as I look around the world, I don't see anybody else, maybe some countries are rising, but China is rising again. China has a huge population. China does not have gigantic debt like America or some countries. In China, you educate your children, you discipline your children, many people work very, very hard. And there are many smart people. And it's a huge market. My children speak Mandarin because of China, I hope I'm preparing them for the 21st century, which will be the century of China.

China has a very bright future

SFC Markets and Finance: What will be the main drivers for the China's economy in the next five years?

Jim Rogers: Mainly that China has a huge educated working population. China does not have gigantic debt. China has built up a lot of assets, a lot of liquidity. China is still a very cheap place to do business, much cheaper than most places. I mean Japan's great, but it's expensive. America's great, but it's expensive. America has a lot of debt. China has a gigantic population, lots of resources and very cheap prices still.

SFC Markets and Finance: Do you think what's the main advantage of China in the future?

Jim Rogers: Low debt compared to other countries and hard working, ambitious. Everybody in China knows about the world now and they want to be rich. I like rich people, nothing wrong with rich people, but the Chinese want to be prosperous and successful. All the Chinese want to be rich now, and many of them will be. Lots of very smart, hardworking people are in China. And don't give up investing in China. I'm not giving up investing in China.

China-US Cooperation for Joint Prosperity

SFC Markets and Finance: AI is a very hot topic now, so how will AI reshape global economic order?

Jim Rogers: AI is going changing and is going to change everything we know. It's going to make some people, some countries extremely rich, extremely rich. Now, I am not a technology person. I'm not smart enough, but if you understand AI and if you understand the technology and the changes that are coming, you're going to be extremely successful, extremely.

So if you can find those people who know what they're doing and who work hard, huge fortunes are going to be made. And a lot of this is going to be here in southern China because there are many people here who very smart, very educated, hard-working. It's a very, very large market, great opportunities.

SFC Markets and Finance: Do you think which country will lead the AI competition?

Jim Rogers: Well, I'd say China, China for many reasons. Maybe South Korea. But probably South Korea, China, India. India is rising and changing. India, China, South Korea, America, those are probably the best places. China (is) better because China has less debt than many countries.

SFC Markets and Finance: How about the US-China relation?

Jim Rogers: It's been astonishing what's happened in US-China relations in my lifetime. I first came to China and I was scared because American propaganda had told me that the Chinese were evil, vicious, dangerous people. I got here and I said, so they're not. They're smart, hardworking, ambitious people. They educated, they disciplined their children. And I became very, very excited about China.

America and China for many years worked together and prospered together. It will probably be less good development in the future for a while because of the competition. China and the US, throughout history, you have had two top countries working together and being successful. So it can work, it can be good.

Investors should remain vigilant in 2026

SFC Markets and Finance: So looking ahead to 2026, what opportunities or challenges do you see?

Jim Rogers: Be careful. I am worried about 2026 everywhere. Everybody is doing extremely well for a long time, the longest ever in history. But overconfidence is building, exuberance is building. And many people think it will last forever. Don't worry. When nobody is worried, I start to worry. And that's what I worry about in 2026. That things have been so good for everybody for so long that usually leads to a problem. That has often led to a problem in history. It probably will again. Big debt is building up, prices are getting extremely expensive makes me worry.

SFC Markets and Finance: So let's be cautious in 2026.

Jim Rogers: Be cautious, be careful, be worried, and be hopeful.

Chief Producer: Zhao Haijian

Supervising Producer: Shi Shi

Editor: Li Yinong

Reporter: Shi Shi, Yang Yulai

Video Editor: Li Qun

Poster Design: Lin Junming

New Media Coordination: Ding Qingyun, Zeng Tingfang, Lai Xi1, Huang Daxun

Overseas Operations Supervising Producer: Huang Yanshu

Overseas Content Coordinator: Huang Zihao

Overseas Operations Editors: Zhuang Huan, Wu Wanjie, Long Lihua, Zheng Quanyi

Produced by: Southern Finance Media Gorp.

(作者:施诗,杨雨莱 编辑:李依农)